Simply put, a dividend is a payment you receive from a company you own.

It’s your share of the profits!

Let’s pretend you just opened up your own discount brokerage account. Now, for your first move you buy 100 shares of DIVICENTS CORP! for $10 per each share. It’s a great company that pays out a yearly dividend to its shareholders (you) of $1 per share. So you would receive $1 x 100 shares every year! That’s $100 dollars in your pocket just for being a part owner of this great company! Not a bad deal if you ask me.

Most dividends are paid out every quarter (3 months) and can be changed when ever the board of directors sees fit. If the company makes more money the greater the chance they are going to give you, the owner, part of that profit. Remember, the board of directors, the people at the top who are making the decisions, are most likely large shareholder who want that pay cheque as well!

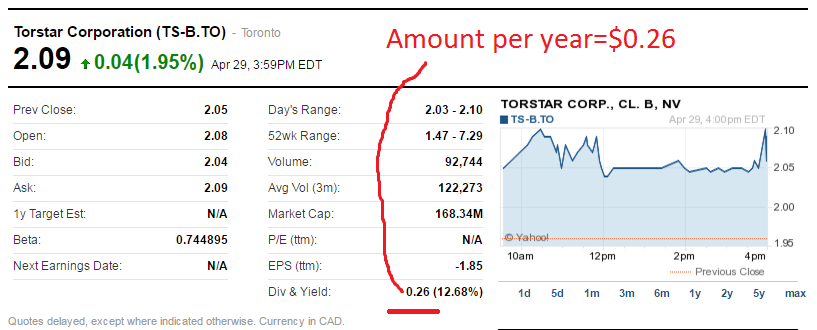

To find out what a company pays for a dividend is pretty easy. Just go onto any resource site such as Yahoo Finance or Google Finance and type in the company name. You will get a ton of information but what we are looking for here is the dividend.

It will look something like this.

I’m using a company called Torstar on Yahoo finance for an example. It pays $0.26 per year per share. If you owned 100 shares you would receive $26 per year! That pays out a huge yield of 13.27% !!! If you are like I was at the beginning of my investing life you are probably thinking that is GREAT!

Now this is a huge RED flag.

Our next step is to look at the dividend yield.