Hello, August is over. I’m back from holidays, ready to get back to work and collect some dividends!

The last update I had was $733.18 for May and I was making pretty good headway for the year. This year I planned to take most of the summer off and focus on my family and in hindsight it was not only the right move but an awesome move!

I feel rejuvenated, refreshed and ready to keep pushing forward.

Saying that, I was still expecting my dividends to keep rolling in and was looking forward to a good few months.

This year, my goal is to pass $8,000 in total dividends received. Let’s check out what happened in June, July and August.

June, July, August Dividend Income

For the month of June I received dividends from 18 different companies, July -14 and August – 13.

| Dividends | ||||

| Ticker | Company Name | June | July | August |

| TSE:NVU.UN | Northview Apartment REIT | $85.01 | $104.57 | $105.25 |

| TSE:PZA | Pizza Pizza | $17.97 | $18.04 | $18.11 |

| O | Reality Income | $21.10 | $21.15 | $21.15 |

| TSE:AD | Alaris | $27.27 | $27.41 | $27.54 |

| TSE:ENF | Enbridge | $58.34 | $84.18 | $90.68 |

| TSE:SJR.B | Shaw | $30.91 | $31.01 | $31.11 |

| TSE:ALA | AtlaGas | $70.88 | $71.23 | $71.58 |

| TSE:CPG | Cresent | $15.09 | $15.12 | $15.15 |

| TSE:AX.UN | Artis REIT | $102.96 | $103.59 | $104.31 |

| TSE:PLZ.UN | Plaza REIT | $73.85 | $89.96 | $90.41 |

| TSE:AQN | Algonquin | $224.94 | ||

| WDC | Western Digital | $35.00 | ||

| TSE:ZLB | BMO LOW VOL ETF | $148.93 | ||

| WPC | W.P. Carey | $100.00 | ||

| TSE:RY | Royal Bank | $91.35 | ||

| OHI | Omega | $76.80 | ||

| GIS | General Mills | $32.34 | ||

| TSE:SU | Suncor | $46.08 | ||

| NVDA | Nvidia | $7.00 | ||

| TSE:BIP.UN | Brookfield Infr | $59.31 | ||

| TSE:PTG | Pivot | $66.80 | ||

| TSE:CWB | Canadian Western Bank | $97.75 | ||

| TSE:ENB | Enbridge | $146.40 | ||

| TSE:D.UN | Dream Office REIT | $38.38 | ||

| TSE:XTC | Exco Technologies | $31.20 | ||

| TOTAL | $996.30 | $1,075.13 | $775.78 |

- I received $996.30 in dividends for the month of June

- I received $1075,13 in dividends for the month of July (BOOM)

- I received $775.78 in dividends for the month of August

$4 dollars.

Yup, I was $4 bucks off of hitting the $1000 mark for June but managed to hit that milestone one month later in July 🙂

The last 3 months brought in a total of $2847.21

Dividend Increase and highlights

- Realty Income – 1%, 92nd increase since 1994

- Enbridge – 10% Mar 1st. , 5% June 1st. 22nd consecutive years

- W.P. Carey – 1%, 16 consecutive years, 3rd raise this year

- Omega Healthcare – 1.6%, Omega has now increased its common dividend 20 consecutive quarters

- General Mills – 2%, General Mills have paid dividends without interruption for 118 years

What can I buy

with all that free money that I banked over the summer without lifting a finger?

AMSEC BLC3024 C-Rated Burglar Safe

$ 2,720.00

To hold all the money these companies are throwing my way!

In all seriousness, everyone should have a safe but I choose to keep valuables in a safety deposit box at the bank for around $4 dollars a month.

Like every month, I DRIP my dividends and buy back more shares, usually at a market discount. This is the secret to investing.

The money that I make (dividends) will now continue to make their own money! And on and on it goes.

The reason I like to invest my money through dividend reinvesting is 2 parts.

- I don’t pay a transaction fee, which doesn’t seem like much, but they do add up fast.

- I get a DRIP discount on new shares below market price, usually by around 3-5%

Nuts and Bolts

June

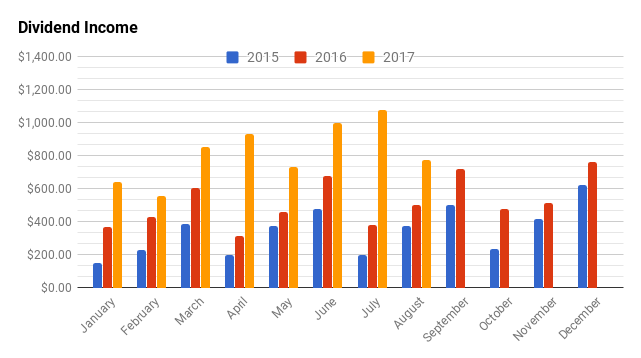

- My year over year increase for June was 47.13% or $318.62 more than June 2016

- My quarter over quarter increase was 16.95% or $144.12 more than 3 months ago

July

- My year over year increase for July was 182.93% or $695.13 more than July 2016

- My quarter over quarter increase was 15.36% or $143.19 more than 3 months ago

August

- My year over year increase for August was 54.85% or $274.78 more than August 2016

- My quarter over quarter increase was 5.81% or $42.60 more than 3 months ago

| Month | 2015 | 2016 | 2017 | 2017 $ INC | 2017 % INC |

| January | $152.00 | $367.00 | $639.12 | $272.12 | 74.15% |

| February | $229.00 | $427.00 | $557.24 | $130.24 | 30.50% |

| March | $385.00 | $602.00 | $850.50 | $248.50 | 41.28% |

| April | $201.00 | $313.00 | $931.94 | $618.94 | 197.74% |

| May | $375.00 | $456.00 | $733.18 | $277.18 | 60.79% |

| June | $475.00 | $676.00 | $994.62 | $318.62 | 47.13% |

| July | $200.00 | $380.00 | $1075.13 | $695.13 | 182.93% |

| August | $375.00 | $501.00 | $775.78 | $274.78 | 54.85% |

| September | $499.00 | $716.88 | $0.00 | 0 | 0.00% |

| October | $236.00 | $479.38 | $0.00 | 0 | 0.00% |

| November | $418.00 | $514.57 | $0.00 | 0 | 0.00% |

| December | $624.00 | $760.03 | $0.00 | 0 | 0.00% |

| YTD Total | $4,169.00 | $6,192.86 | $6,557.51 | $2,835.51 | 0.00% |

One of my goals for 2017 is to increase my dividend payout an average of $170 per month over the previous year. I’m moving quite ahead of schedule with an average increase of $354.44 per month. ($2,835/8).

My total dividend haul this year has already passed my 2016 total and we still have 4 more months to collect juicy dividends.

How Much Free Money?

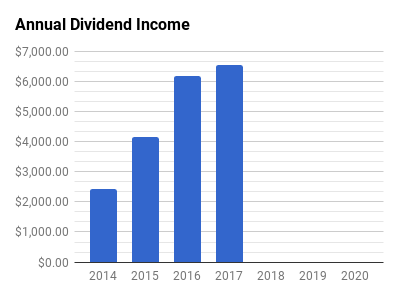

| Year | Total Dividends Received |

| 2014 | $2,421.00 |

| 2015 | $4,169.00 |

| 2016 | $6,193.00 |

| 2017 | $6,557.51 |

| 2018 | $0.00 |

| 2019 | $0.00 |

| 2020 | $0.00 |

| Total | $19,340.37 |

Since 2014 I have received $19,340.37 worth of dividends. This does not include any capital appreciation.

Every month I like to see what my total dividend income could purchase if I chose to spend it on non investing stuff.

Turns out I could buy a …

2017 Subaru Impreza

It looks pretty fancy but I think I can still pound out a few more miles on my 2007 honda civic and keep my dividends rolling over.

Until next time.

Stay classy Fire bros