Hello and welcome!

March 2018, what a whirlwind of a month, seriously busy.

Just a few of the things going on in March.

- My wife started a new job

- 3 kids all playing high level sports where my wife coaches on the oldest kids team which is way more work than it sounds.

- I’m working my normal 60+ hours a week at my day job

- Finalizing my US businesses

- Rebalancing my portfolio

- Streamlining all my bills and organizing my budget (things ran away last year)

- Started my 10 week workout (I’m doing the Whistler Tough Mudder in June) with no carbs. Steve is GETTING ANGRY!!!

Kidding aside, although March was really busy, it is all positive stuff and I’m truly blessed to have the life I do.

With that being said…

Let’s check out March 2018

Moves

- Bought more Enbridge at $40

- Added some Royal Bank

- Started a new (small) position in VXC All world ex Canada, Vanguard ETF

- Started a P2P lending position on Lending Loop. This is the first peer to peer lender that has been approved in Canada. I’ll update the progress in future posts.

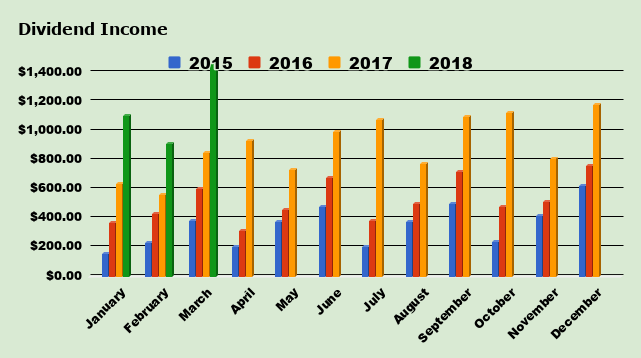

Dividend Income

For the month of March I received dividends from 18 different companies.

| Ticker | Company Name | March |

| TSE:ENB | Enbridge | $436.15 |

| TSE:ENF | Enbridge | $147.82 |

| TSE:NVU.UN | Northview Apartment REIT | $109.05 |

| TSE:AX.UN | Artis REIT | $108.81 |

| TSE:PLZ.UN | Plaza REIT | $97.16 |

| TSE:CWB | Canadian Western Bank | $93.75 |

| TSE:ALA | AtlaGas | $77.20 |

| TSE:BIP.UN | Brookfield Infr | $63.75 |

| TSE:SU | Suncor | $52.92 |

| TSE:HLF | Highliner | $50.75 |

| TSE:CU | Canadian Utility | $49.16 |

| ADM | Archer | $41.88 |

| TSE:SJR.B | Shaw | $31.80 |

| TSE:FN | First Nat | $30.99 |

| TSE:AD | Alaris | $28.49 |

| O | Realty Income | $21.90 |

| TSE:PZA | Pizza Pizza | $18.61 |

| TSE:CPG | Cresent | $15.36 |

| TOTAL | $1,475.55 |

- I received $1,475.55 in dividends for March 2018

Well, as you can see I wasn’t joking when I said I was buying up Enbridge. A single company represented about 33% of my months dividends. Normally I’m a pretty rational human being and would never load up a single stock, but whatever. I think it’s a steal and I’m still buying!

Dividend Increase and highlights

-

Enbridge increases dividend by 10% (20 year dividend CAGR of 11.7% without missing a payment in 64 years )

-

Suncor increases dividend by 12.5% (15 consecutive years of raises)

-

Brookfield increase dividend by 8.2% (10 consecutive years of increase)

-

Canadian Utility increases dividend by 10% (46 consecutive years of increase)

- Archer Daniels increases dividend by 4% (25+ consecutive years of increase)

I own 24 companies at the start of 2018.

10 of 24 companies I own have increased their dividend payout this year.

- Realty Income

- Suncor

- Enbridge

- Brookfield

- Canadian Utility

- Archer Daniel

- Enbridge Income

- Plaza REIT

- W.P. Carey

- Omega Healthcare

I had 0 Dividend cuts in 2017.

I have not had a dividend cut so far this year.

Nuts and Bolts

March 2018

- My year over year increase for March was 73.79% or $625.05 more than March 2017.

- My quarter over quarter increase was up 25.35% or $298.41 more than 3 months. (I try to increase my Q-Q by over $60)

| Month | 2015 | 2016 | 2017 | 2018 (Total) | 2018 ($Inc) | 2018 (%Inc) |

| January | $152.00 | $367.00 | $639.12 | $1,104.37 | $465.25 | 72.80% |

| February | $229.00 | $427.00 | $557.24 | $913.47 | $356.23 | 63.93% |

| March | $385.00 | $602.00 | $850.50 | $1,475.55 | $625.05 | 73.79% |

| April | $201.00 | $313.00 | $931.94 | |||

| May | $375.00 | $456.00 | $733.18 | |||

| June | $475.00 | $676.00 | $994.62 | |||

| July | $200.00 | $380.00 | $1,075.13 | |||

| August | $375.00 | $501.00 | $775.78 | |||

| September | $499.00 | $716.88 | $1,093.00 | |||

| October | $236.00 | $479.38 | $1,124.71 | |||

| November | $418.00 | $514.57 | $808.15 | |||

| December | $624.00 | $760.03 | $1,177.14 | |||

| YTD Total | $4,169.00 | $6,192.86 | $10,760.51 | $3,493.39 | $1,446.23 |

My average increase so far this year is $482.18 per month. ($1,446.23/3)

One of my goals for this year is to increase my dividend payout an average of $200 per month over the previous year. It was originally set at $170 per month but I almost doubled that goal last year so I upped it a little bit.

How Much Free Money?

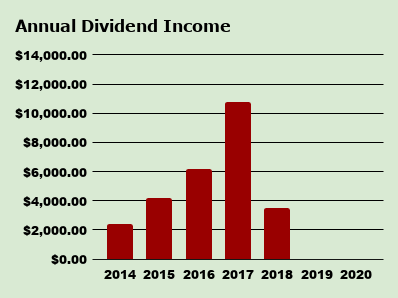

I’ve earned $3,493.39 in dividends so far this year. I’ve already earned more in 3 months than I did in the whole of 2014!

That’s crazy to me

| Year | Total Dividends Received |

| 2014 | $2,421 |

| 2015 | $4,169 |

| 2016 | $6,193 |

| 2017 | $10,760 |

| 2018 | $3,493 |

| 2019 | $0.00 |

| 2020 | $0.00 |

| Total | $27.036 |

My total dividend goal this year is $12,000. I increased this goal from $10,000 to $12,000 to keep in line with my growth.

Since 2014 I have received $27,036 worth of dividends. This does not include any capital appreciation.

What can I buy with all my free money?

Every month, after I have tallied my dividend totals, I like to see what I could do with all the free money. I do this for two reasons.

The first being that I like to feel rewarded for my hard work and when I can imagine what the money could buy me, it becomes more real than say, 20 shares of company xyz.

The second reason is that I fully expect to look back here in say a decade and ponder what could have been. What if I decided to buy that new Honda Civic instead of shares of XYZ corp. I’m almost certain the shares of XYZ corp will be much more valuable in a decade than any item I purchase.

Now, saying that, I’m going to buy a brand new…

2018 Subaru WRX

You probably shouldn’t jump it. But other than that, the new Subaru WRX faithfully emulates its late rally-car muse. On gravel, snow, or asphalt, it transforms its driver into someone with an unpronounceable Scandinavian name. This is the affordable all-weather sports car.

…

Until next time.

Stay classy Fire bros