Can you believe February 2018 is already over?

Seriously 2018, you need to slow down…

Well, as many of you may know, the market was not very good for last month so I did what any smart investor would do.

I liquidated everything.

I kid.

“The intelligent investor is a realist who sells to optimists and buys from pessimists.” – Benjamin Graham.

I picked up some more Enbridge on the cheap and I’m going to buy a little CN Rail and Fortis coming up if they stay put. I also will keep on buying my ZLB.TO etf. It should hold strong in a bear market.

That’s the plan anyhow.

Let’s check out February 2018

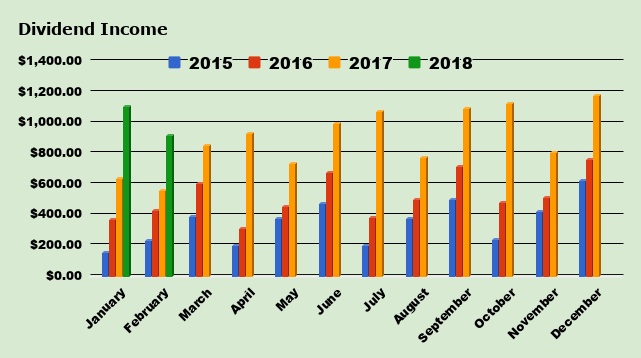

Dividend Income

For the month of February I received dividends from 14 different companies.

| Ticker | Company Name | Febuary |

| TSE:ENF | Enbridge | $146.87 |

| TSE:RY | Royal Bank | $118.30 |

| TSE:NVU.UN | Northview Apartment REIT | $108.50 |

| TSE:AX.UN | Artis REIT | $108.18 |

| TSE:PLZ.UN | Plaza REIT | $96.60 |

| OHI | Omega | $79.20 |

| TSE:ALA | AtlaGas | $76.83 |

| GIS | General Mills | $32.34 |

| TSE:SJR.B | Shaw | $31.70 |

| TSE:FN | First Nat | $30.83 |

| TSE:AD | Alaris | $28.35 |

| O | Realty Income | $21.90 |

| TSE:PZA | Pizza Pizza | $18.54 |

| TSE:CPG | Cresent | $15.33 |

| TOTAL | $913.47 |

- I received $913.47 in dividends for February 2018

I’m hoping this will be the last month that I collect under $1000 for the month. I still need to make $87 more next quarter and that will be a challenge in and of itself.

Dividend Increase and highlights

-

Enbridge Income increases dividend by 10% (8 consecutive years of raises)

-

Plaza Retail increases dividend by 3.7% (15 consecutive years of raises)

- Omega Healthcare increase dividend by 1.3% (22 consecutive increase)

I own 24 companies at the start of 2018.

5 of 24 companies I own have increased their dividend payout this year.

- Realty Income

- Enbridge Income

- Plaza REIT

- W.P. Carey

- Omega Healthcare

I had 0 Dividend cuts in 2017.

I have not had a dividend cut so far this year.

Nuts and Bolts

February 2018

- My year over year increase for February was 63.93% or $356.23 more than February 2017.

- My quarter over quarter increase was up 13.31% or $105.32 more than 3 months. (I try to increase my Q-Q by over $60)

| Month | 2015 | 2016 | 2017 | 2018 (Total) | 2018 ($Inc) | 2018 (%Inc) |

| January | $152.00 | $367.00 | $639.12 | $1,104.37 | $465.25 | 72.80% |

| February | $229.00 | $427.00 | $557.24 | $913.47 | $356.23 | 63.93% |

| March | $385.00 | $602.00 | $850.50 | |||

| April | $201.00 | $313.00 | $931.94 | |||

| May | $375.00 | $456.00 | $733.18 | |||

| June | $475.00 | $676.00 | $994.62 | |||

| July | $200.00 | $380.00 | $1,075.13 | |||

| August | $375.00 | $501.00 | $775.78 | |||

| September | $499.00 | $716.88 | $1,093.00 | |||

| October | $236.00 | $479.38 | $1,124.71 | |||

| November | $418.00 | $514.57 | $808.15 | |||

| December | $624.00 | $760.03 | $1,177.14 | |||

| YTD Total | $4,169.00 | $6,192.86 | $10,760.51 | $2,017.84 | $821.48 |

My average increase so far this year is $410.74 per month. ($821.48/2)

One of my goals for this year is to increase my dividend payout an average of $200 per month over the previous year. It was originally set at $170 per month but I almost doubled that goal last year so I upped it a little bit.

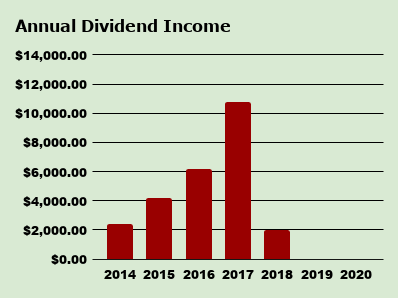

How Much Free Money?

I’ve earned $2017.84 in dividends so far this year.

| Year | Total Dividends Received |

| 2014 | $2,421 |

| 2015 | $4,169 |

| 2016 | $6,193 |

| 2017 | $10,760 |

| 2018 | $2,017 |

| 2019 | $0.00 |

| 2020 | $0.00 |

| Total | $25,561 |

My total dividend goal this year is $12,000. I increased this goal from $10,000 to $12,000 to keep in line with my growth.

Since 2014 I have received $25,561 worth of dividends. This does not include any capital appreciation.

What can I buy with all my free money?

Every month, after I have tallied my dividend totals, I like to see what I could do with all the free money. I do this for two reasons.

The first being that I like to feel rewarded for my hard work and when I can imagine what the money could buy me, it becomes more real than say, 20 shares of company xyz.

The second reason is that I fully expect to look back here in say a decade and ponder what could have been. What if I decided to buy that new Honda Civic instead of shares of XYZ corp. I’m almost certain the shares of XYZ corp will be much more valuable than any item I purchase.

Now, saying that, I’m going to buy a brand new…

2018 Kodiak 233RBSL Ultra

Sale Price

$23,895

One of the hottest selling floor plans in our Surveyor…we now have it in a Kodiak! This unit has a front queen island bed, u shaped dinette slide, huge rear with walk in shower, power awning and tongue jack, alum wheels, TV and much more…..

Nah, I think I’ll buy some more Royal Banks Shares instead at around $100 per share.

Until next time.

Stay classy Fire bros