Hi,

I’ve been busy…

I bought a rental property in a foreign land (USA) and started 3 companies.

Here is my numbers for October, Nov and Dec 2017.

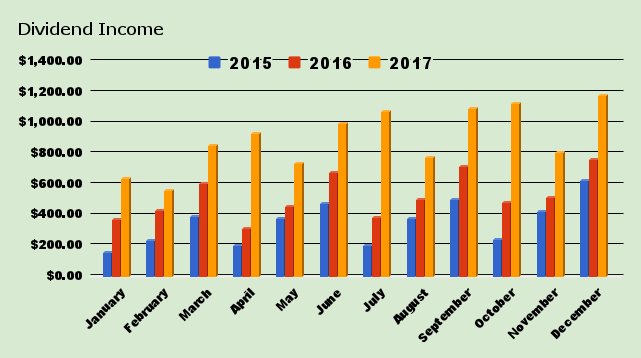

Dividend Income

For the month of October I received dividends from 14 different companies, November 13 and a total of 16 in December

| Ticker | Company Name | Oct | Nov | Dec |

| TSE:NVU.UN | Northview Apartment REIT | $106.33 | $106.87 | $107.42 |

| TSE:PZA | Pizza Pizza | $18.25 | $18.32 | $18.40 |

| O | Realty Income | $21.20 | $21.20 | $21.20 |

| TSE:AD | Alaris | $27.81 | $27.95 | $28.08 |

| TSE:ENF | Enbridge | $110.02 | $110.53 | $111.04 |

| TSE:SJR.B | Shaw | $31.30 | $31.41 | $31.51 |

| TSE:ALA | AtlaGas | $72.28 | $72.63 | $76.10 |

| TSE:CPG | Cresent | $15.21 | $15.24 | $15.27 |

| TSE:AX.UN | Artis REIT | $105.66 | $106.29 | $106.92 |

| TSE:PLZ.UN | Plaza REIT | $91.35 | $91.82 | $92.30 |

| TSE:AQN | Algonquin | $225.00 | ||

| WDC | Western Digital | $35.00 | ||

| TSE:ZLB | BMO LOW VOL ETF | $164.80 | ||

| WPC | W.P. Carey | $100.50 | ||

| TSE:RY | Royal Bank | $95.55 | ||

| OHI | Omega | $78.00 | ||

| GIS | General Mills | $32.34 | ||

| TSE:SU | Suncor | $46.72 | ||

| NVDA | Nvidia | $7.50 | ||

| TSE:BIP.UN | Brookfield Infr | $60.18 | ||

| TSE:PTG | Pivot | $66.80 | ||

| TSE:CWB | Canadian Western Bank | $103.44 | ||

| TSE:ENB | Enbridge | $284.26 | ||

| TOTAL | $1,124.71 | $808.15 | $1,177.14 |

- I received $1124 in dividends for the month of October

- November haul was $808

- I hit a new record in December with a huge $1177

At the beginning of the year I was hoping to get at least one month above $1000 dollars but now I’m pretty close to hitting $1200!

Dividend Increase and highlights

- AltaGas – $0.175 to $0.1825 per Month

15 out of my 23 companies have raised their dividends so far this year.

5 out of my 23 companies have raised their dividends 2 or more times so far this year.

I have not had a dividend cut so far this year.

Nuts and Bolts

October

- My year over year increase for October was 134.62% or $645.33 more than October 2016

- My quarter over quarter increase was 4.61% or $49.58 more than 3 months ago

November

- My year over year increase for October was 57.05% or $293.58 more than November 2016

- My quarter over quarter increase was 4.17% or $32.37 more than 3 months ago

December

- My year over year increase for December was 54.88% or $417.11 more than December 2016

- My quarter over quarter increase was 7.70% or $84.14 more than 3 months ago

| Month | 2015 | 2016 | 2017 | 2017 $ INC | 2017 % INC |

| January | $152.00 | $367.00 | $639.12 | $272.12 | 74.15% |

| February | $229.00 | $427.00 | $557.24 | $130.24 | 30.50% |

| March | $385.00 | $602.00 | $850.50 | $248.50 | 41.28% |

| April | $201.00 | $313.00 | $931.94 | $618.94 | 197.74% |

| May | $375.00 | $456.00 | $733.18 | $277.18 | 60.79% |

| June | $475.00 | $676.00 | $994.62 | $318.62 | 47.13% |

| July | $200.00 | $380.00 | $1,075.13 | $695.13 | 182.93% |

| August | $375.00 | $501.00 | $775.78 | $274.78 | 54.85% |

| September | $499.00 | $716.88 | $1093.00 | $376.12 | 52.47% |

| October | $236.00 | $479.38 | $1,124.71 | $645.33 | 137.62% |

| November | $418.00 | $514.57 | $808.15 | $293.58 | 57.05% |

| December | $624.00 | $760.03 | $1,177.14 | $417.11 | 54.88% |

| YTD Total | $4,169.00 | $6,192.86 | $10,760.51 | $4,567.65 | 73.76% |

One of my goals for 2017 is to increase my dividend payout an average of $170 per month over the previous year.

Yeah, I killed that.

My average increase was $380.63 per month. ($4,567.65/12)

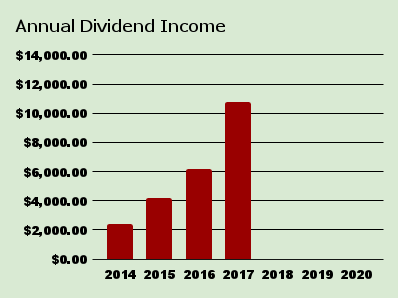

How Much Free Money?

I’ve earned $10,760 in dividends this year.

| Year | Total Dividends Received |

| 2014 | $2,421 |

| 2015 | $4,169 |

| 2016 | $6,193 |

| 2017 | $10,760 |

| 2018 | $0.00 |

| 2019 | $0.00 |

| 2020 | $0.00 |

| Total | $23,543 |

My total dividend haul this year crushed my goal of $8,000. I’m going to increase my next yyears goal from $10,000 to $12,000 to keep in line with my growth.

Since 2014 I have received $23,543 worth of dividends. This does not include any capital appreciation.

Another goal finished!

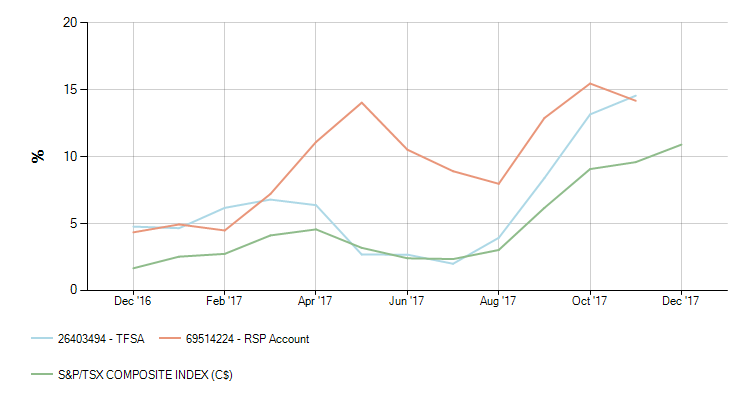

A horrible graph but it shows that I beat the market again for the third straight year. This graph is straight from my bank and it doesn’t include dividends so I’m actually up significantly more. (RBC, get your act together)

A horrible graph but it shows that I beat the market again for the third straight year. This graph is straight from my bank and it doesn’t include dividends so I’m actually up significantly more. (RBC, get your act together)

Every month I like to see what my total dividend income could purchase if I chose to spend it on consumer stuff.

Turns out I could buy a …

2017 Honda Accord

Starting Price: $22,455

Until next time.

Stay classy Fire bros