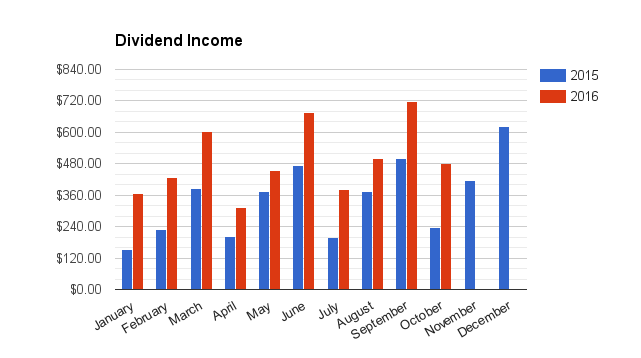

Last month was a new personal best with a dividend income of $716.88 in September. Let’s check out my dividend income for October to see where I end up.

But First

HALLOWEEN!

Halloween has come and gone and November is upon us. Everywhere I go, I hear complaints about this time of year. I live in Vancouver so it is wet, cold and cloudy almost all the time. But, perspective is everything!

I get to hang-out inside with the family and watch movies and play card games and get some real quality time together.

The rain gives me the perfect excuse to sloth around in my jogging pants. I love this time of year.

October Dividend Income

For the month of October I received dividends from 13 different companies (and 1 company twice):

| TICKER | COMPANY | Oct 2016 |

| TSE:CLF | Laddered Government Bond | $61.55 |

| WDC | Western Digital Corp | $60.00 |

| TSE:PLZ.UN | Plaza Retail REIT | $54.70 |

| TSE:DRG.UN | Dream Global Real Estate | $54.67 |

| TSE:AX.UN | Artis Real Estate | $47.97 |

| TSE:NVU:UN | Northview Apartment Real Estate | $45.36 |

| TSE:NVU.UN | Northview Apartment Real Estate | $29.33 |

| BEN | Franklin Resources Inc | $27.00 |

| TSE:REI.UN | Riocan Real Estate | $23.97 |

| TSE:D.UN | Dream Office Real Estate | $22.75 |

| TSE:BEI.UN | Boardwalk Real Estate | $19.13 |

| TSE:PZA | Pizza Pizza | $15.90 |

| TSE:XLB | Canadian Long Term Bond | $9.79 |

| TSE:ECA | Encana Corp | $7.26 |

| TOTAL | $479.38 |

I received $479.38 in dividends for the month of October. I’m very happy with this total as October is my lowest quarter of the three.

As you can see from the list above, over half of my dividend income is from REITs and I am very aware that I am overexposed to that sector at the moment.

There are 2 reasons for this.

The first reason is, I am finding it very hard to buy any company I consider overvalued. When reading through Warren Buffett’s letters, the one thing that he consistently states is that you look for reasons not to buy a stock. When you can’t find any reason not to buy it, then you pull the trigger.

I have been close to buying several different companies but there has been something that is just not right. The last company I bought was Western Digital and that was back in August.

I’m not going to buy a company just “because.” It has to make sense.

The second reason I’m overweight in REITs is because they pay huge yields that are safe and I buy new shares on the DRIP. When I buy new shares using a DRIP I usually get around a 3% discount on market price and the new shares compound. Even if the REIT doesn’t raise the payout, my payout grows every month. I like that.

Nuts and Bolts

- My year over year increase was 103.13% or $243.38 more then 2015

- My quarter over quarter increase was 26.15%

Month |

2015 |

2016 |

$INC 2016 |

%INC 2016 |

Q OVER Q %INC |

| January | $152.00 | $367.00 | $215.00 | 141.45% | 55.51% |

| February | $229.00 | $427.00 | $198.00 | 86.46% | 2.15% |

| March | $385.00 | $602.00 | $217.00 | 56.36% | -3.53% |

| April | $201.00 | $313.00 | $112.00 | 55.72% | -14.71% |

| May | $375.00 | $456.00 | $81.00 | 21.60% | 6.79% |

| June | $475.00 | $676.00 | $201.00 | 42.32% | 12.29% |

| July | $200.00 | $380.00 | $180.00 | 90.00% | 21.41% |

| August | $375.00 | $501.00 | $126.00 | 33.60% | 9.87% |

| September | $499.00 | $716.88 | $217.88 | 43.66% | 6.05% |

| October | $236.00 | $479.38 | $243.38 | 103.13% | 26.15% |

Every quarter there are 3 months or dividend payouts, this is the smallest one.

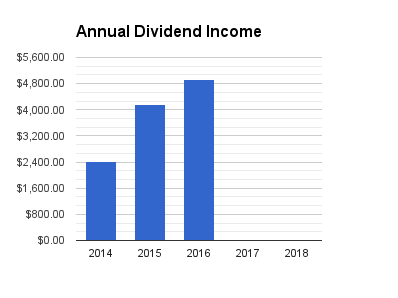

My total dividend haul this year is now $4918.26, already $749.26 more than my last years TOTAL!!

I have already crushed my last years total and I still have 2 full months left in the year!

I’m hoping to reach my goal of $6000, it will be close 🙂