Last month was a slow month with a dividend income of $479.38 in October. Let’s check out my dividend income for November to see where I end up.

November Dividend Income

For the month of November I received dividends from 14 different companies (and 1 company twice):

| Ticker | Company Name | Nov |

| TSE:RY | Royal Bank | $87.15 |

| TSE:CLF | Bonds | $61.72 |

| TSE:DRG.UN | Dream Global REIT | $55.07 |

| TSE:PLZ.UN | Plaza REIT | $54.91 |

| TSE:AX.UN | Artis REIT | $48.33 |

| TSE:NVU.UN | Northview Apartment REIT | $45.63 |

| TSE:NVU.UN | Northview Apartment REIT | $29.47 |

| TSE:REI.UN | RioCan REIT | $23.97 |

| TSE:D.UN | Dream Office REIT | $22.88 |

| TSE:BEI.UN | Boardwalk REIT | $19.13 |

| TSE:XBB | Bonds | $18.17 |

| TSE:PZA.UN | Pizza Pizza | $15.97 |

| TSE:PWF | Power Financial | $14.92 |

| TSE:XLB | Bonds | $9.84 |

| TSE:SJR.B | Shaw Communications | $7.41 |

| TOTAL | $514.57 |

I received $514.75 in dividends for the month of November. Over $500 dollars for doing very little work. Enough free money to cover the payments of a new car! It’s crazy to think that my dividends alone could buy me a free car.

Nuts and Bolts

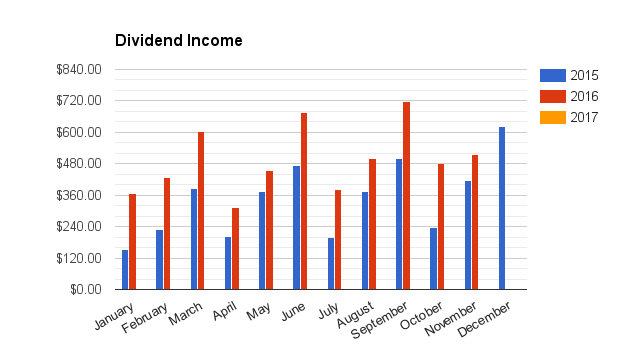

- My year over year increase was 23.10% or $96.57 more then 2015

- My quarter over quarter increase was 2.71%

- I had very little growth this quarter due to saving cash and not buying very much.

| Month | 2015 | 2016 | 2016 $INC | 2016 %INC |

| January | $152.00 | $367.00 | $215.00 | 141.45% |

| February | $229.00 | $427.00 | $198.00 | 86.46% |

| March | $385.00 | $602.00 | $217.00 | 56.36% |

| April | $201.00 | $313.00 | $112.00 | 55.72% |

| May | $375.00 | $456.00 | $81.00 | 21.60% |

| June | $475.00 | $676.00 | $201.00 | 42.32% |

| July | $200.00 | $380.00 | $180.00 | 90.00% |

| August | $375.00 | $501.00 | $126.00 | 33.60% |

| September | $499.00 | $716.88 | $217.88 | 43.66% |

| October | $236.00 | $479.38 | $243.38 | 103.13% |

| November | $418.00 | $514.57 | $96.57 | 23.10% |

Every quarter there are 3 months or dividend payouts, this is the middle one.

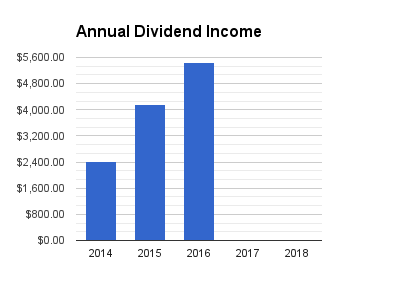

My total dividend haul this year is now $5432.83, already $1,263 more than my last years TOTAL!!

I have already crushed my last years total but I only have 1 more month to reach my goal of $6,000

How Much Free Money?

| Year | Total Dividends Received |

| 2014 | $2,421.00 |

| 2015 | $4,169.00 |

| 2016 | $5,432.83 |

| 2017 | $0.00 |

| 2018 | $0.00 |

| 2019 | $0.00 |

| 2020 | $0.00 |

| Total | $12,022.83 |

Since 2014 I have received $12,022.83 of free money just to own some companies.

How cool is that!