Last month I received a dividend income of $557.24 for the month of February. It was a good month in terms of YoY growth and met the expectation of not having a month this year under the $500 mark. February is typically the worst month of the year for my dividend schedule. This should be the last time I ever see a $500 month and I expect March to crush that benchmark.

This year, my goal is to pass $8,000 in total dividends received. Let’s check out March.

March Dividend Income

For the month of March I received dividends from 18 different companies.

| Ticker | Company Name | Dividend |

| TSE:AX.UN | Artis REIT | $101.07 |

| TSE:NVU.UN | Northview Apartment REIT | $84.06 |

| TSE:CWB | Canadian Western Bank | $83.03 |

| TSE:PLZ.UN | Plaza REIT | $72.83 |

| ORI | Old Republic | $66.50 |

| TSE:CLF | Bonds | $55.32 |

| TSE:BIP.UN | Brookfield Infr | $52.00 |

| TSE:TS.B | TorStar | $50.00 |

| CVE:PTG | Pivot | $50.00 |

| TSE:SU | Suncor | $45.76 |

| TSE:ALA | AtlaGas | $40.25 |

| TSE:D.UN | Dream Office REIT | $38.00 |

| TSE:XTC | Exco Technologies | $31.20 |

| TSE:SJR.B | Shaw | $30.71 |

| TSE:PZA | Pizza Pizza | $16.04 |

| TSE:CPG | Cresent | $15.00 |

| TSE:POW | Power Corp | $11.73 |

| NVDA | Nvidia | $7.00 |

| TOTAL | $850.50 |

I received $850.50 in dividends for the month of March.

This is a new personal record, blowing past my Dec 2016 record of $760. That is an increase of $90 in a measly 3 months.

I can’t wait to go out and spend all this free money. What should I buy with my $850 bucks? Maybe a new…

His and Hers Apple Watch 2: $369 each.

Nope!

As any reader knows, I prefer to spend my dividends on things that go up in value. I chose to DRIP my dividends.

I know many people don’t like to DRIP and prefer to take cash instead. The reason I like to invest my money through dividend reinvesting is 2 parts.

- I don’t pay a transaction fee, which doesn’t seem like much, but they do add up fast.

- I get a DRIP discount on new shares below market price, usually by around 3-5%

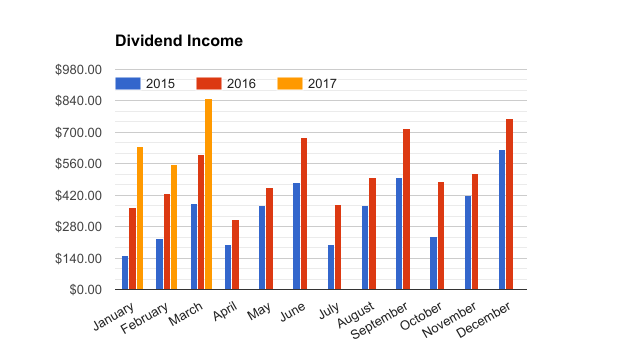

Orange is my new favorite colour.

Nuts and Bolts

- My year over year increase was 41.20% or $248.50 more than March 2016

- My quarter over quarter increase was 11.90%

- Another solid quarter

| Month | 2015 | 2016 | 2017 | 2017 $ INC | 2017 % INC |

| January | $152.00 | $367.00 | $639.12 | $272.12 | 74.15% |

| February | $229.00 | $427.00 | $557.24 | $130.24 | 30.50% |

| March | $385.00 | $602.00 | $850.50 | $248.50 | 41.28% |

| April | $201.00 | $313.00 | $0.00 | 0 | 0.00% |

| May | $375.00 | $456.00 | $0.00 | 0 | 0.00% |

| June | $475.00 | $676.00 | $0.00 | 0 | 0.00% |

| July | $200.00 | $380.00 | $0.00 | 0 | 0.00% |

| August | $375.00 | $501.00 | $0.00 | 0 | 0.00% |

| September | $499.00 | $716.88 | $0.00 | 0 | 0.00% |

| October | $236.00 | $479.38 | $0.00 | 0 | 0.00% |

| November | $418.00 | $514.57 | $0.00 | 0 | 0.00% |

| December | $624.00 | $760.03 | $0.00 | 0 | 0.00% |

| YTD Total | $4,169.00 | $6,192.86 | $2,046.86 | $650.86 | 0.00% |

One of my goals for 2017 is to increase my dividend payout an average of $170 per month over the previous year. I’m slightly ahead of schedule with an average increase of $216.95 per month. ($650.86/3)

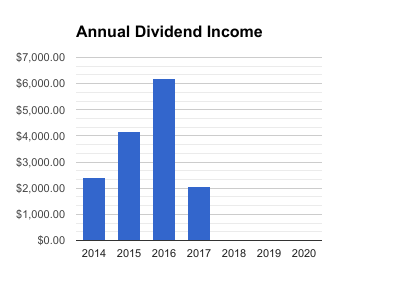

My total dividend haul this year is getting very close to my 2014 total year! I’m currently sitting at $2,046.86 and it’s only April 1st. It’s crazy to think that I have already accumulated 95% of my 2014 total in just 3 months! How cool is that.

How Much Free Money?

| Year | Total Dividends Received |

| 2014 | $2,421.00 |

| 2015 | $4,169.00 |

| 2016 | $6,193.00 |

| 2017 | $2,046.86 |

| 2018 | $0.00 |

| 2019 | $0.00 |

| 2020 | $0.00 |

| Total | $14,8299 |

Since 2014 I have received $14,829 worth of dividends. This does not include any capital appreciation.

Every month I like to see what my dividend income can purchase if I chose to spend it on frivolous stuff. Seeing as my monthly dividend bought me a pair of his and her Apple Watches, I found a couple of nice Rolexes for just over $12,000 and would still have enough left over for a nice holiday.

Rolex Milgauss 116400 and 116400GV.

Stay classy Fire bros