Last month I received a dividend income of $850.50 for March. I crushed my year over year increase goal of $170 per month with a legit $248.50 increase. I’m hoping to keep this momentum going as I press forward through April.

This year, my goal is to pass $8,000 in total dividends received. Let’s check it out.

April Dividend Income

For the month of April I received dividends from 16 different companies.

| Ticker | Company Name | Dividend |

| TSE:AQN | Algonquin | $232.84 |

| TSE:AX.UN | Artis REIT | $101.70 |

| WPC | W.P. Carey | $99.50 |

| TSE:NVU.UN | Northview Apartment REIT | $84.20 |

| TSE:PLZ.UN | Plaza REIT | $73.17 |

| TSE:ALA | AtlaGas | $70.18 |

| TSE:ZLB | BMO LOW VOL ETF | $40.70 |

| TSE:D.UN | Dream Office REIT | $38.13 |

| TSE:TA | TransAlta | $35.76 |

| WDC | Western Digital | $35.00 |

| TSE:SJR.B | Shaw | $30.80 |

| TSE:AD | Alaris | $27.00 |

| O | Reality Income | $21.10 |

| TSE:PZA | Pizza Pizza | $17.83 |

| TSE:CPG | Cresent | $15.03 |

| NKE | Nike | $9.00 |

| Total | $931.94 |

I received $931.94 in dividends for the month of April.

This is a new personal record, blowing past last month’s record $850.

With over $900 bucks burning a hole in my pocket, it’s time to go shopping! With spring in the air, I think I will buy a brand new…

Weber Genesis II E-410 gas grill.

Price$900.00

With evenness performance and the ability to cook over 28 hamburgers at the same time, I would be a fool not to purchase this exquisite beast of master cookery.

I guess I’m a fool.

Like every month, I DRIP my dividends and buy back more shares, usually at a market discount. This is the secret to investing.

The money that I make (dividends) will now continue to make their own money! And on and on it goes.

The reason I like to invest my money through dividend reinvesting is 2 parts.

- I don’t pay a transaction fee, which doesn’t seem like much, but they do add up fast.

- I get a DRIP discount on new shares below market price, usually by around 3-5%

Nuts and Bolts

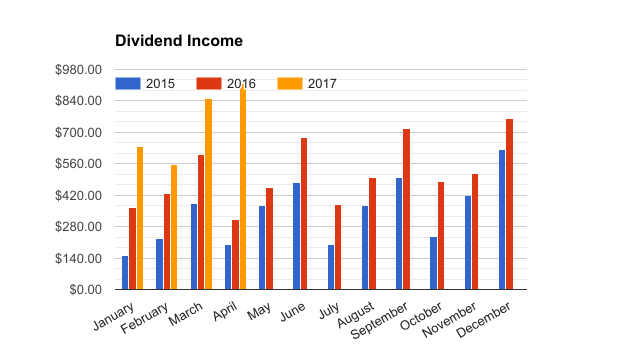

- My year over year increase was 197.74% or $618.94 more than April 2016

- My quarter over quarter increase was 45.82%

- This was a ridiculous quarter almost entirely due to my new position in AQN

- I do not expect to ever see this big of a gain again unless I win the lotto.

| Month | 2015 | 2016 | 2017 | 2017 $ INC | 2017 % INC |

| January | $152.00 | $367.00 | $639.12 | $272.12 | 74.15% |

| February | $229.00 | $427.00 | $557.24 | $130.24 | 30.50% |

| March | $385.00 | $602.00 | $850.50 | $248.50 | 41.28% |

| April | $201.00 | $313.00 | $931.94 | $618.94 | 197.74% |

| May | $375.00 | $456.00 | $0.00 | 0 | 0.00% |

| June | $475.00 | $676.00 | $0.00 | 0 | 0.00% |

| July | $200.00 | $380.00 | $0.00 | 0 | 0.00% |

| August | $375.00 | $501.00 | $0.00 | 0 | 0.00% |

| September | $499.00 | $716.88 | $0.00 | 0 | 0.00% |

| October | $236.00 | $479.38 | $0.00 | 0 | 0.00% |

| November | $418.00 | $514.57 | $0.00 | 0 | 0.00% |

| December | $624.00 | $760.03 | $0.00 | 0 | 0.00% |

| YTD Total | $4,169.00 | $6,192.86 | $2,978.80 | $1269.80 | 0.00% |

One of my goals for 2017 is to increase my dividend payout an average of $170 per month over the previous year. I’m moving quite ahead of schedule with an average increase of $317.45 per month. ($1269.80/4). Saying that, I don’t expect to keep up at this breakneck pace through summer.

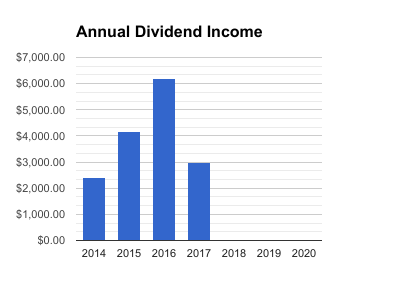

My total dividend haul this year has already passed my 2014 total year! I’m currently sitting at $2,978.80 and it’s only May 1st. It’s crazy to think that I have already passed my 2014 total in just 4 months! How cool is that.

My total dividend haul this year has already passed my 2014 total year! I’m currently sitting at $2,978.80 and it’s only May 1st. It’s crazy to think that I have already passed my 2014 total in just 4 months! How cool is that.

How Much Free Money?

| Year | Total Dividends Received |

| 2014 | $2,421.00 |

| 2015 | $4,169.00 |

| 2016 | $6,193.00 |

| 2017 | $2,978.80 |

| 2018 | $0.00 |

| 2019 | $0.00 |

| 2020 | $0.00 |

| Total | $15,761.66 |

Since 2014 I have received $15,761.66 worth of dividends. This does not include any capital appreciation.

Every month I like to see what my total dividend income could purchase if I chose to spend it on frivolous stuff. Seeing as my monthly dividend bought me a fancy new BBQ, I thought what else could I buy to enhance my chef type abilities?

Turns out I could buy a whole darn kitchen 🙂

I wouldn’t call this a frivolous purchase and If I did spend my dividends it would most likely be on something like this, I know my wife would like it 🙂

Unfortunately for her, I’m a dividend reinvestor and one day (maybe) my dividends dividends can buy her one of these.

Until then,

Stay classy Fire bros