What have I been up to? 2017 Trading history so far

Good question!

This is my trading history so far this year.

| DATE | BUY/SELL | COMPANY | SHARES | PRICE |

| 2017-01-17 | Sell | Magna International Inc. | 20 | $57.50 |

| 2017-01-17 | Buy | Algonquin Power & Utilities Corp | 1006 | $11.35 |

| 2017-01-23 | Buy | Altagas Ltd | 50 | $32.29 |

| 2017-02-06 | Buy | Crescent Point Energy Corp | 200 | $14.05 |

| 2017-02-07 | Buy | Brookfield Infrastructure Partners L.P. | 54 | $46.20 |

| 2017-02-10 | Buy | Shaw Communications Inc | 235 | $28.10 |

| 2017-02-10 | Buy | ISHARES 1-5 YR LADDER GOVT BOND ETF | 1213 | $18.54 |

| 2017-02-21 | Sell | Boardwalk REIT | 100 | $44.60 |

| 2017-02-21 | Buy | Exco Technologies Limited | 390 | $11.65 |

| 2017-02-27 | Buy | Enbridge Inc | 110 | $55.60 |

| 2017-02-27 | Sell | American International Group Inc | 100 | $63.78 |

| 2017-02-27 | Sell | Franklin Resources, Inc. | 150 | $42.47 |

| 2017-02-27 | Sell | Old Republic International Corporation | 350 | $20.51 |

| 2017-03-06 | Buy | Alaris Royalty Corp. | 200 | $21.67 |

| 2017-03-08 | Buy | Realty Income Corp | 100 | $58.30 |

| 2017-03-13 | Buy | Pizza Pizza Royalty Corp | 25 | $17.14 |

| 2017-03-15 | Buy | Shopify Inc | 60 | $85.67 |

| 2017-03-20 | Buy | Altagas Ltd | 200 | $30.89 |

| 2017-03-22 | Buy | Nike Inc | 50 | $54.78 |

| 2017-03-22 | Buy | W.P. Carey Inc. REIT | 100 | $61.14 |

| 2017-03-27 | Buy | BMO Low Volatility Canada Equity ETF | 220 | $29.34 |

| 2017-03-30 | Buy | Pivot Technology Solutions Inc | 420 | $1.68 |

| 2017-04-05 | Buy | Omega Healthcare Investors Inc | 120 | $33.35 |

| 2017-04-05 | Buy | General Mills, Inc. | 66 | $58.64 |

| 2017-04-07 | Buy | Enbridge Inc | 44 | $56.50 |

| 2017-04-21 | Sell | TransAlta Corporation | 898 | $7.04 |

| 2017-04-21 | Buy | Enbridge Income Fund Holdings Inc | 187 | $33.73 |

| 2017-04-21 | Buy | Enbridge Inc | 46 | $56.00 |

| 2017-05-05 | Buy | Enbridge Inc | 40 | $56.00 |

| 2017-05-17 | Sell | Power Financial Corp | 38 | $32.08 |

| 2017-05-17 | Buy | Canadian Western Bank | 62 | $25.50 |

| 2017-05-19 | Buy | Enbridge Inc | 40 | $53.39 |

| 2017-05-05 | Buy | Enbridge Income Fund Holdings Inc | 153 | $32.50 |

| 2017-05-30 | Buy | BMO Low Volatility Canada Equity ETF | 395 | $30.00 |

| 2017-06-02 | Buy | Enbridge Inc | 40 | $52.71 |

| 2017-06-14 | Buy | Enbridge Inc | 40 | $50.42 |

Pretty standard moves so far.

As you can see, I’m moving pretty heavy into utilities.

I plan on owning around 500 shares of ENB so I will keep buying this company until I feel like my weight is right. It currently pays $0.61 per quarter dividend and has raised it twice so far this year with the expectation of a 10% increase per year until 2024.

What have I been up to? 2017 Trading history so far Read More »

Nope, my yard is too small. Plus I have a outdoor public pool that costs $2 for the day!

Nope, my yard is too small. Plus I have a outdoor public pool that costs $2 for the day!

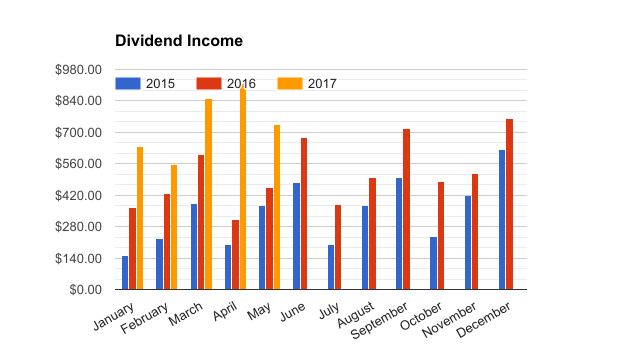

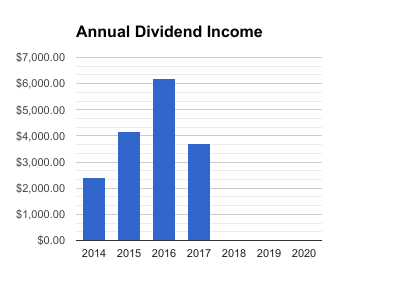

My total

My total

My total

My total