DIVIDEND INCOME – SEPTEMBER 2017

Hi, what a September!

I must admit, it was hard getting back to work after taking much of the summer off. I just finished a 30 day non stop work project that had me working close to 100 hours per week.

I’m also getting close to buying my first real estate investment property and it’s very consuming.

The last update I had was $775.78 for August. I didn’t buy too many stocks throughout the summer but my dividends kept rolling in.

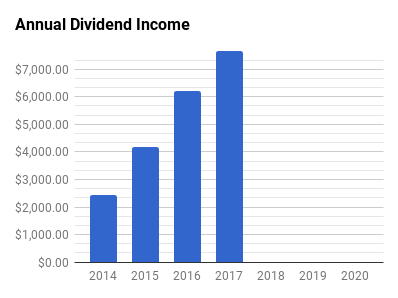

My goal for this year is to collect over $8000 in dividends and as of my last update in August I was sitting at a total of $6,557, already surpassing last year’s total!

Here is my numbers for September 2017.

September Dividend Income

For the month of September I received dividends from 16 different companies.

| Ticker | Company Name | September 2017 |

| TSE:ENB | Enbridge | $220.82 |

| TSE:NVU.UN | Northview Apartment REIT | $105.79 |

| TSE:AX.UN | Artis REIT | $104.94 |

| TSE:ENF | Enbridge | $103.00 |

| TSE:CWB | Canadian Western Bank | $102.72 |

| TSE:PLZ.UN | Plaza REIT | $90.88 |

| TSE:ALA | AtlaGas | $71.93 |

| TSE:PTG | Pivot | $66.80 |

| TSE:BIP.UN | Brookfield Infr | $59.31 |

| TSE:SU | Suncor | $46.40 |

| TSE:SJR.B | Shaw | $31.22 |

| TSE:AD | Alaris | $27.68 |

| O | Realty Income | $21.15 |

| TSE:PZA | Pizza Pizza | $18.18 |

| TSE:CPG | Cresent | 15.18 |

| NVDA | Nvidia | $7.00 |

| TOTAL | $1,093.00 |

- I received $1093.00 in dividends for the month of September

Another record breaking month.

At the beginning of the year I was hoping to get at least one month above $1000 dollars but now I’m pretty close to hitting $1100! After all of the grinding I’ve done in the last 5 years I feel like it’s starting to pay off, literally 🙂

Dividend Increase and highlights

- Canadian Western Bank – $0.23 to $0.24 per Q

14 out of my 23 companies have raised their dividends so far this year.

4 out of my 23 companies have raised their dividends 2 or more times so far this year.

I have not had a dividend cut so far this year.

What can I buy?

Well, a funny thing happened to me the other week. My wife and I were looking at booking a quick trip to mexico and as I was looking at the places I thought to myself “my dividends could pay for my trip.”

Even a few weeks later I find it hard to believe that every month my dividends could buy me a week of an all inclusive vacation to Mexico!

Grand Sunset Princess All Suites and Spa Resort

$1075

I could live a quarter of my life here just from my dividends!

That’s crazy… but why settle for a week a month, why not all month/all year.

That’s the reason I like to DRIP my dividends and buy back more shares, usually at a market discount. This is the secret to investing. Low cost (or zero cost) fees to purchase more compounding shares.

The money that I make (dividends) will now continue to make their own money! And on and on it goes.

The reason I like to invest my money through dividend reinvesting is 2 parts.

- I don’t pay a transaction fee, which doesn’t seem like much, but they do add up fast.

- I get a DRIP discount on new shares below market price, usually by around 3-5%

Nuts and Bolts

September

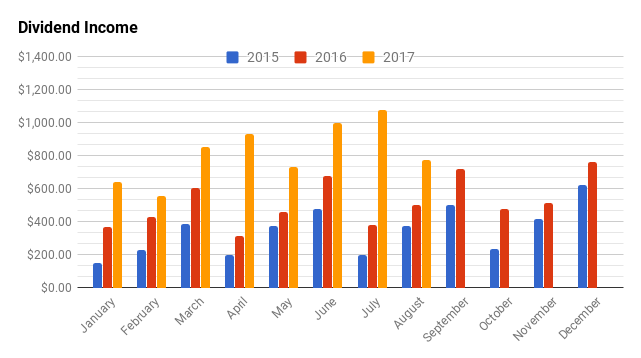

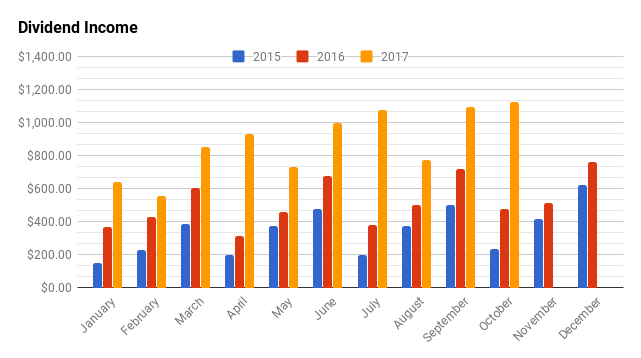

- My year over year increase for September was 52.47% or $376.12 more than September 2016

- My quarter over quarter increase was 9.89% or $98.38 more than 3 months ago

| Month | 2015 | 2016 | 2017 | 2017 $ INC | 2017 % INC |

| January | $152.00 | $367.00 | $639.12 | $272.12 | 74.15% |

| February | $229.00 | $427.00 | $557.24 | $130.24 | 30.50% |

| March | $385.00 | $602.00 | $850.50 | $248.50 | 41.28% |

| April | $201.00 | $313.00 | $931.94 | $618.94 | 197.74% |

| May | $375.00 | $456.00 | $733.18 | $277.18 | 60.79% |

| June | $475.00 | $676.00 | $994.62 | $318.62 | 47.13% |

| July | $200.00 | $380.00 | $1075.13 | $695.13 | 182.93% |

| August | $375.00 | $501.00 | $775.78 | $274.78 | 54.85% |

| September | $499.00 | $716.88 | $1093.00 | $376.12 | 52.47% |

| October | $236.00 | $479.38 | $0.00 | 0 | 0.00% |

| November | $418.00 | $514.57 | $0.00 | 0 | 0.00% |

| December | $624.00 | $760.03 | $0.00 | 0 | 0.00% |

| YTD Total | $4,169.00 | $6,192.86 | $7,650.51 | $3,211.63 | 0.00% |

One of my goals for 2017 is to increase my dividend payout an average of $170 per month over the previous year. I’m moving quite ahead of schedule with an average increase of $356.85 per month. ($3,211.63/9).

How Much Free Money?

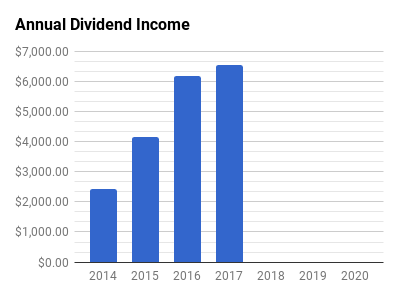

I’ve earned $7,650.51 in dividends for the first 9 months of this year.

| Year | Total Dividends Received |

| 2014 | $2,421.00 |

| 2015 | $4,169.00 |

| 2016 | $6,193.00 |

| 2017 | $7,650.51 |

| 2018 | $0.00 |

| 2019 | $0.00 |

| 2020 | $0.00 |

| Total | $20,433.37 |

My total dividend haul this year has already passed my 2016 total and creeping up on my 2017 goal of $8,000. We still have 3 more months to go and I should pass my goal next month.

Since 2014 I have received $20.422.37 worth of dividends. This does not include any capital appreciation.

Every month I like to see what my total dividend income could purchase if I chose to spend it on non investing stuff.

Turns out I could buy a …

A trip around the world

How to travel the world for a year for less than $20K

Don’t get me wrong, I do want to travel the world but for now I’m going to keep stacking these dividends.

Until next time.

Stay classy Fire bros

DIVIDEND INCOME – SEPTEMBER 2017 Read More »