Dividend Income Report – April 2018 – July 2018

Where Have I been and what have I been up too?

I’m just wrapping up my final rehab on my 3rd rental property.

Dividend Income

For the month of April, I received dividends from 18 different companies.

In the month of May, I received dividends from 15 different companies.

For the month of June, I received dividends from 19 different companies.

For the month of July, I received dividends from 19 different companies.

| Ticker | Company Name | Apr | May | Jun | Jul |

| TSE:ENF | Enbridge | $148.76 | $149.70 | $150.64 | $151.58 |

| TSE:NVU.UN | Northview Apartment REIT | $109.59 | $110.13 | $110.68 | $111.22 |

| TSE:AX.UN | Artis REIT | $109.44 | $110.16 | $110.86 | $111.60 |

| TSE:PLZ.UN | Plaza REIT | $99.32 | $99.90 | $100.46 | $100.89 |

| TSE:ALA | AtlaGas | $77.75 | $78.29 | $78.84 | $79.39 |

| TSE:SJR.B | Shaw | $31.90 | $32.00 | $32.10 | $32.19 |

| TSE:FN | First Nat | $31.14 | $31.30 | $31.45 | $31.60 |

| TSE:AD | Alaris | $28.62 | $28.76 | $33.89 | $34.16 |

| O | Realty Income | $21.95 | $21.95 | $21.95 | $22.00 |

| TSE:PZA | Pizza Pizza | $18.68 | $18.75 | $18.82 | $18.89 |

| TSE:CPG | Cresent | $15.39 | $15.42 | $15.45 | $15.48 |

| TSE:SOT.UN | Slate office | $6.25 | |||

| LL | Lending Loop | $1.50 | $3.26 | $6.26 | $9.00 |

| TSE:AQN | Algonquin | $230.07 | $264.68 | ||

| TSE:ZLB | BMO LOW VOL ETF | $187.40 | $184.40 | ||

| WPC | W.P. Carey | $101.50 | $102.00 | ||

| TSE:CM | CIBC | $133.00 | $134.33 | ||

| TSE:VXC | Van World | $4.27 | $4.27 | ||

| TSE:BCE | Bell | $49.48 | |||

| TSE:BNS | Scotia Bank | $82.00 | |||

| TSE:RY | Royal Bank | $123.14 | |||

| OHI | Omega | $79.20 | |||

| GIS | General Mills | $32.34 | |||

| TSE:SU | Suncor | $53.28 | |||

| TSE:BIP.UN | Brookfield Infr | $63.73 | |||

| TSE:CWB | Canadian Western Bank | $93.75 | |||

| TSE:ENB | Enbridge | $465.67 | |||

| TSE:HLF | Highliner | $50.75 | |||

| TSE:CU | Canadian Utility | $49.56 | |||

| ADM | Archer | $41.88 | |||

| BTE | Baytex | ||||

| TOTAL | $1,350.28 | $934.30 | $1,530.02 | $1,545.41 |

- I received $1,350.28 in dividends for April 2018

- $934.30 in dividends for May 2018

- $1,530.02 in dividends for June 2018

- And lastly, I received $1,545.41 in dividends for July 2018

Dividend Increase and highlights

I currently own 31 companies.

17 of 31 companies I own have increased their dividend payout this year.

- Realty Income x3!

- Suncor

- Enbridge

- Brookfield

- Canadian Utility

- Archer Daniel

- Enbridge Income

- Plaza REIT

- W.P. Carey x2!

- Omega Healthcare

- CIBC

- VXC

- Royal Bank

- Algonquin Power

- BCE Bell

- Scotia Bank

- Candain Western

I had 0 Dividend cuts in 2017.

I have not had a dividend cut so far this year.

Nuts and Bolts

April-July 2018

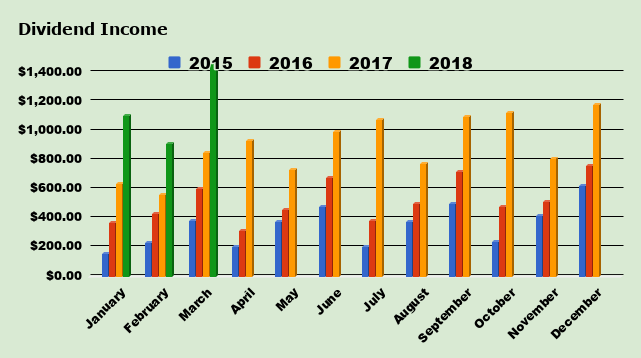

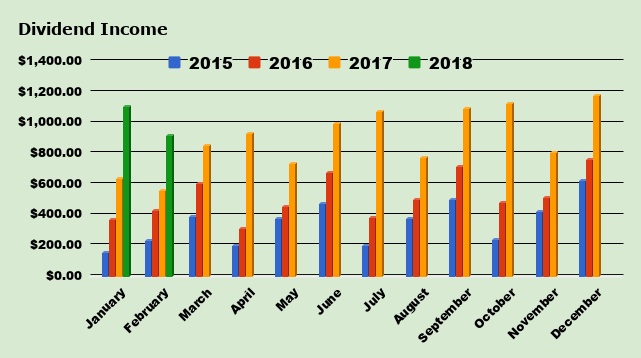

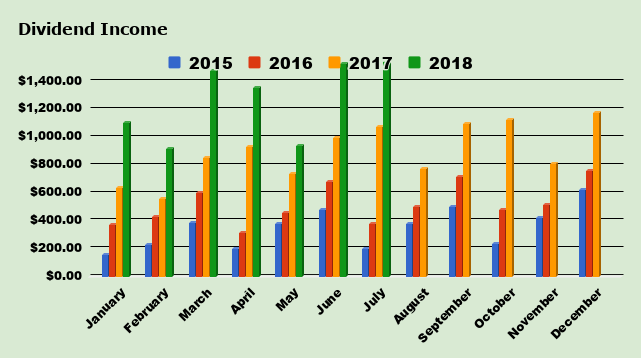

| Month | 2015 | 2016 | 2017 | 2018 (Total) | 2018 ($Inc) | 2018 (%Inc) |

| January | $152.00 | $367.00 | $639.12 | $1,104.37 | $465.25 | 72.80% |

| February | $229.00 | $427.00 | $557.24 | $913.47 | $356.23 | 63.93% |

| March | $385.00 | $602.00 | $850.50 | $1,475.55 | $625.05 | 73.79% |

| April | $201.00 | $313.00 | $931.94 | $1,356.52 | $424.57 | 45.56% |

| May | $375.00 | $456.00 | $733.18 | $934.30 | $201.12 | 27.43% |

| June | $475.00 | $676.00 | $994.62 | $1,530.02 | $535.38 | 53.83% |

| July | $200.00 | $380.00 | $1,075.13 | $1,545.41 | $467.28 | 43.46% |

| August | $375.00 | $501.00 | $775.78 | |||

| September | $499.00 | $716.88 | $1,093.00 | |||

| October | $236.00 | $479.38 | $1,124.71 | |||

| November | $418.00 | $514.57 | $808.15 | |||

| December | $624.00 | $760.03 | $1,177.14 | |||

| YTD Total | $4,169.00 | $6,192.86 | $10,760.51 | $8,856.61 | $3,074.88 |

My average increase so far this year is $439.26 per month. ($3,074.88/7)

One of my goals for this year is to increase my dividend payout an average of $200 per month over the previous year. It was originally set at $170 per month but I almost doubled that goal last year so I upped it a little bit.

How Much Free Money?

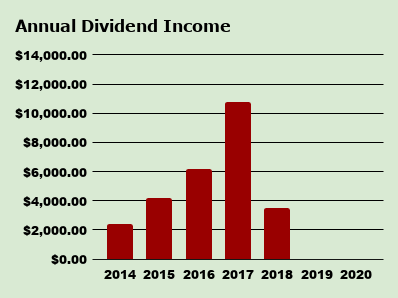

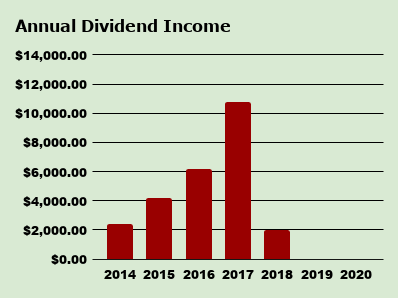

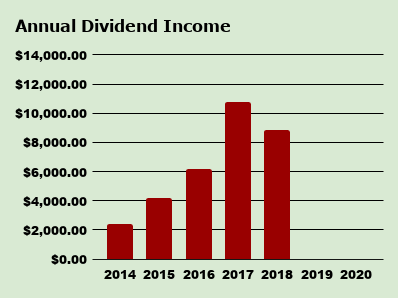

I’ve earned $8,856.61 in dividends so far this year.

I’ve already doubled my 2015 total in just 7 months!

That’s crazy to me

| Year | Total Dividends Received |

| 2014 | $2,421 |

| 2015 | $4,169 |

| 2016 | $6,193 |

| 2017 | $10,760 |

| 2018 | $8,856.61 |

| 2019 | $0.00 |

| 2020 | $0.00 |

| Total | $32,399.98 |

My total dividend goal this year is $12,000. I increased this goal from $10,000 to $12,000 to keep in line with my growth.

Since 2014 I have received $$32,399.98 worth of dividends. This does not include any capital appreciation.

Stay classy Fire bros

Dividend Income Report – April 2018 – July 2018 Read More »