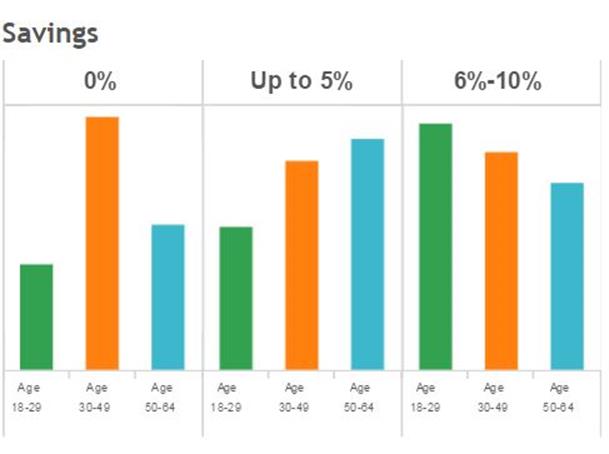

Millennials get a bad rap for not caring about their finances.

But according to a recent Bankrate survey, these young bucks are starting to flip the script and have started saving a bigger chunk of their paychecks than any other age group.

Most millennials are starting to understand the importance of saving money, but it’s tricky to know where to start and what products to trust.

The Best Free Saving Tools For Millennials

Think investing is only for guys in suits? Nope. This app rounds up every purchase you make to the nearest dolla and invests the difference into a diversified stock portfolio. Once you earn $5, the money can be transferred into your Acorns savings account. Acorns it a great way to start saving automatically with virtually no effort.

This is the first financial app I ever used. I still use it several years later! This money managing app securely connects your financial accounts, automatically organizes and categorizes your expenses, and helps you create a budget. It’s basically shows you your whole financial life and sums it up. Pretty legit.

Digit is a perfect app for someone like myself. Basically it watches your spending and sneaks away a little bit of money every now and again when it (a robot!) thinks you won’t miss it. It sticks the money into a savings account that you can access whenever you want.

Feex is a service that reveals all the fees that you are paying in accounts you invest with. It’s often overlooked, but these fees can be staggering. Feex finds these costs and suggests other options that can bring the fees down. A very handy tool to understand the costs involved

Yes, you need a budget. I don’t use YNAB because I have made my own budget software (and I love spreadsheets) but I know many bloggers who have nothing but praise for this software. YNAB lets you try their budget program for 34 days free so it doesn’t hurt to find out if it’s for you or not. As I mentioned before in my 3 Simple Steps to Becoming Rich, you need a budget one way or another so get on it!

Final Thoughts

Saving money can seem like a daunting task, especially when you have debt to pay back. The trick is to make small automatic contributions that go to a place where it is more difficult to get at and spend. Using these tools will make the path to padding your savings account that much easier.

Disclosure. I’m not getting paid to promote these. Just stuff I personally use.