Dividend Income Report – January 2018

Hello and happy new year. January 2018, can you believe that? Well, with 2017 firmly in the rearview mirror I can say that it was probably the best year I lived through (so far).

The market was on fire, I bought a 2nd house, started 3 companies and blew past my dividend goals.

Let’s check out January’s progress.

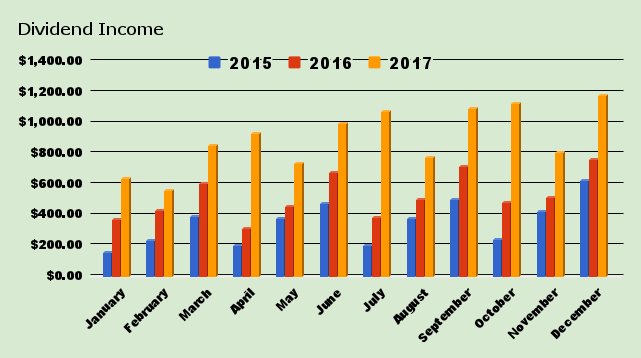

Dividend Income

For the month of January I received dividends from 13 different companies.

| Ticker | Company Name | January |

| TSE:AQN | Algonquin | $226.50 |

| TSE:ZLB | BMO LOW VOL ETF | $166.00 |

| TSE:ENF | Enbridge | $111.56 |

| TSE:NVU.UN | Northview Apartment REIT | $107.96 |

| TSE:AX.UN | Artis REIT | $107.55 |

| WPC | W.P. Carey | $101.00 |

| TSE:PLZ.UN | Plaza REIT | $92.79 |

| TSE:ALA | AtlaGas | $76.47 |

| TSE:SJR.B | Shaw | $31.60 |

| TSE:AD | Alaris | $28.22 |

| O | Realty Income | $21.25 |

| TSE:PZA | Pizza Pizza | $18.47 |

| TSE:CPG | Cresent | $15.00 |

| TOTAL | $1,104.37 |

- I received $1104 in dividends for the month of January

Obviously this is the best start to the year I ever had but passing $1100 so quickly is quite satisfying. All the hard work is really starting to pay dividends 🙂

Dividend Increase and highlights

-

Realty Income Announces Dividend Increase Of 4%

I own 24 companies at the start of 2018.

1 of 24 companies I own have increased their dividend payout this year.

0 Dividend cuts in 2017.

I have not had a dividend cut so far this year.

Nuts and Bolts

January 2018

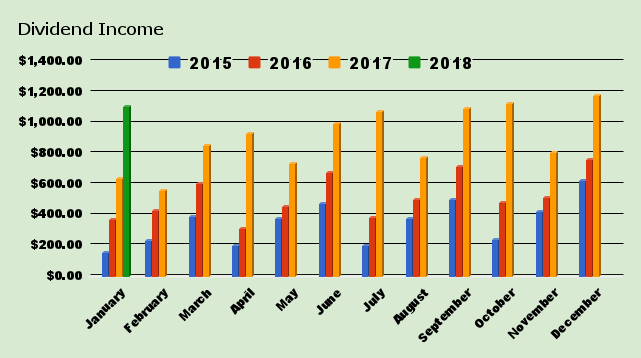

- My year over year increase for January was 72.80% or $465.25 more than January 2017.

- My quarter over quarter increase was down -1.81% or $20.34 less than 3 months ago due to selling Western Digital at a profit of 127% not including dividends.

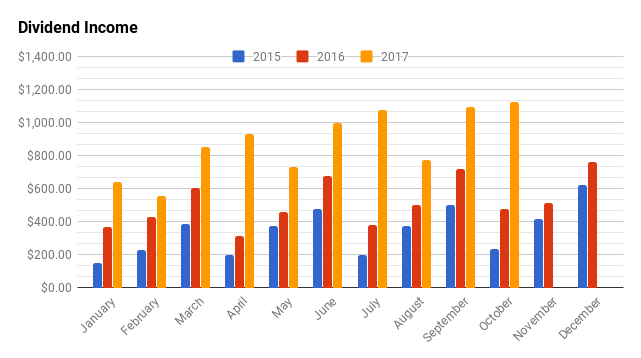

| Month | 2015 | 2016 | 2017 | 2018 (Tot) | 2018 ($) | 2018 (%) |

| January | $152.00 | $367.00 | $639.12 | $1,104.37 | $465.25 | 72.80% |

| February | $229.00 | $427.00 | $557.24 | |||

| March | $385.00 | $602.00 | $850.50 | |||

| April | $201.00 | $313.00 | $931.94 | |||

| May | $375.00 | $456.00 | $733.18 | |||

| June | $475.00 | $676.00 | $994.62 | |||

| July | $200.00 | $380.00 | $1,075.13 | |||

| August | $375.00 | $501.00 | $775.78 | |||

| September | $499.00 | $716.88 | $1,093.00 | |||

| October | $236.00 | $479.38 | $1,124.71 | |||

| November | $418.00 | $514.57 | $808.15 | |||

| December | $624.00 | $760.03 | $1,177.14 | |||

| YTD Total | $4,169.00 | $6,192.86 | $10,760.51 | $1,104.37 | $465.25 | 73.76% |

My average increase so far this year is $465.25 per month. ($465.25/1)

One of my goals for this year is to increase my dividend payout an average of $200 per month over the previous year. It was set at $170 per month but I almost doubled that goal last year so I upped it a little bit.

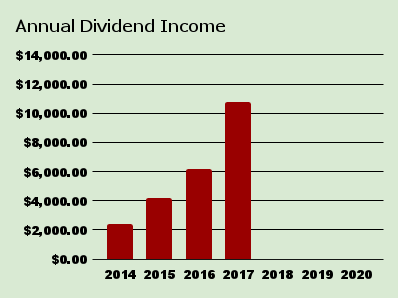

How Much Free Money?

I’ve earned $1,104 in dividends so far this year.

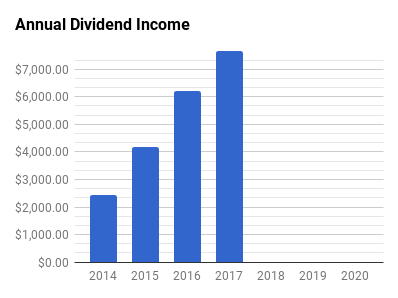

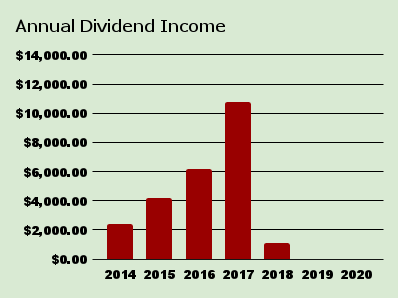

| Year | Total Dividends Received |

| 2014 | $2,421 |

| 2015 | $4,169 |

| 2016 | $6,193 |

| 2017 | $10,760 |

| 2018 | $1,104 |

| 2019 | $0.00 |

| 2020 | $0.00 |

| Total | $24,647 |

My total dividend goal this year is $12,000. I increased this goal from $10,000 to $12,000 to keep in line with my growth.

Since 2014 I have received $24,647 worth of dividends. This does not include any capital appreciation.

Moves

I bought more Enbridge, CIBC, First National, Archer Daniels, Canadian Util, Highliner, ZLB Low Vol, Enbridge Income.

I sold Western Digital and Blackberry.

Until next time.

Stay classy Fire bros

Dividend Income Report – January 2018 Read More »

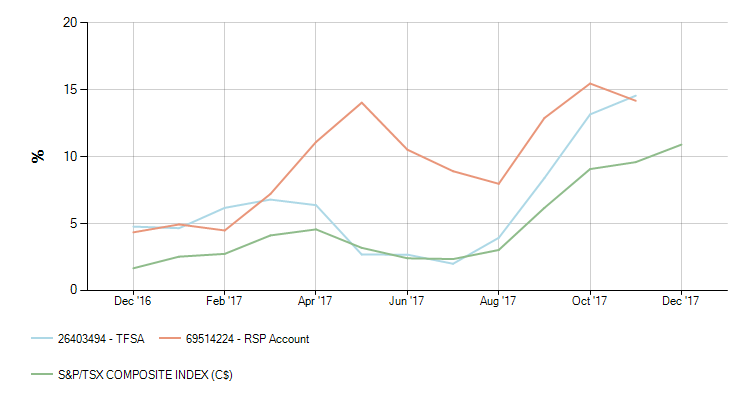

A horrible graph but it shows that I beat the market again for the third straight year. This graph is straight from my bank and it doesn’t include dividends so I’m actually up significantly more. (RBC, get your act together)

A horrible graph but it shows that I beat the market again for the third straight year. This graph is straight from my bank and it doesn’t include dividends so I’m actually up significantly more. (RBC, get your act together)