October 2020 dividend update

October 2020 dividend update Read More »

A book I just picked up on amazon that was recommended to me by a real estate investor friend.

I really enjoyed it. About 95 pages on how to deal with change.

6/10

The book link if anyone is interested. No Affiliate money here, just a link.

Who moved my cheese? Read More »

Hello old friends (and new?). What a wild year so far.

So, I had a bit of time on this long weekend and was cleaning up my site and thought to myself, why not a brief update?

I’m still kicking it old-school but time is so precious that I have been way more busy doing than talking about my doings.

I’ve been working hard on this area of my business for about 2 years now and have made several strides in that time. I am learning and making a little bit of money through the process. I’ve just enrolled in the London School of Economics Real Estate and Economics Certificate program so let’s see how that goes.

I’ll give a good update on this front when I get into the mood.

I’ve accumulated a handful of rentals but I plan on expansion soon

P2P lending going fine but rather boring. I’ve averaged 12.6% per year since 2017 so I guess that’s ok. It’s miles behind my stocks where I’ve doubled my value in under 5 years. My tfsa is over triple the value of the TSX since 2016

Also, on this chart you can see my RRSP started 10% below the index in 2016 so that 80% gain is not accurate. Plus this doesn’t factor in dividends, just saying 🙂

I sold all my stocks on Jan 31, 2020

I’ve been rebuying since the end of March when the US fed decided to use a bazooka and shoot trillions into the economy.

This year, my goal was to pass $20,000 in total dividends received but that changed since I didn’t collect much from dividends at the beginning of the year.

My total haul this year is only breaking $9,000 so far but I expect it to dramatically increase as I have re-entered the market with only about 20% in cash holdings left.

Because I got lucky and sold at the height and bought back in at an average 37% discount, I should be looking at a very nice year next year (if the market doesn’t explode again!)

Having not really looked to close into it, I would guess I should get an average of about $2,000 a month in my tax-free accounts in the form of dividends. I’m not really counting on every company I own keeping the dividends so we shall see.

I’m also holding much of my portfolio in low or non-dividend paying stocks because I keep these in my taxable account until I have more room in my tax-free accounts.

In fact, my largest holding now is BRK-B which doesn’t pay a divi.

| Month | 2018 | 2019 | 2020 |

| January | $1,104.37 | $1,626.86 | $1,595.72 |

| February | $913.47 | $957.73 | $943.22 |

| March | $1,475.55 | $1,501.45 | $40.08 |

| April | $1,356.51 | $1,599.25 | $479.33 |

| May | $934.30 | $972.76 | $277.97 |

| June | $1,530.00 | $1,674.88 | $2,821.26 |

| July | $1,542.41 | $1,668.51 | $1,718.55 |

| August | $984.73 | $891.40 | $1,082.96 |

| September | $1,549.84 | $1,897.46 | |

| October | $1,611.55 | $1,677.00 | |

| November | $1,230.16 | $1,110.34 | |

| December | $1,990.18 | $2,226.97 | |

| YTD Total | $16,223.07 | $17,804.61 | $8,959. |

My total dividend haul this year is like 9g

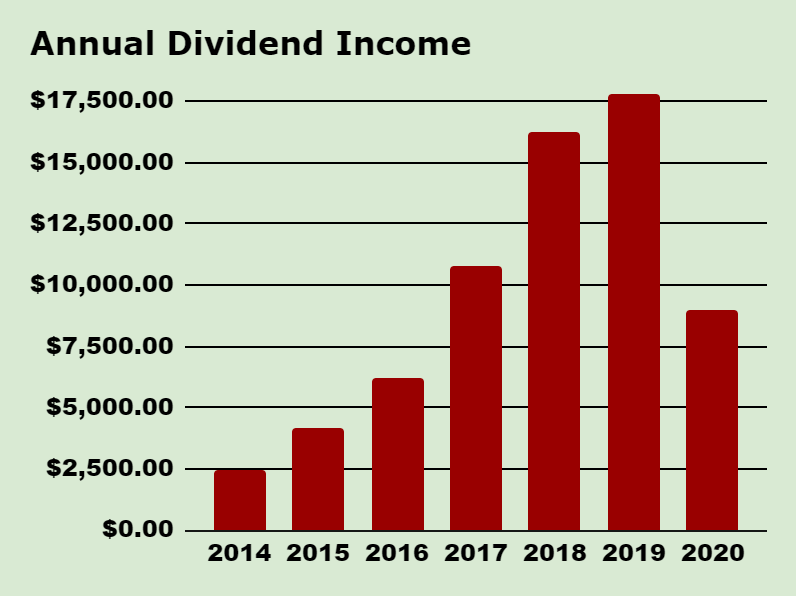

| Year | Total Dividends Received |

| 2014 | $2,421.00 |

| 2015 | $4,169.00 |

| 2016 | $6,192.86 |

| 2017 | $10,760.51 |

| 2018 | $16,223.07 |

| 2019 | $17,804.61 |

| 2020 | $8,959.09 |

| Total Divs | $66,530.14 |

Since 2014 I have received $66,530 worth of dividends. This does not include any capital appreciation.

Every month I like to see what my dividend income can purchase if I chose to spend it on frivolous stuff.

If I saved all my dividends so far I could buy myself a…

and I’d still have a grand left over!

Stay classy Fire bros

Dividend Income – Jan-Aug 2020 ~ And life update :) Read More »