Dividend Income – December 2016

Last month was a good month with a dividend income of $514.57 for the month of November. I want to try and keep my monthly dividends above that $500 mark. My dividend income for December should smash that, it was my top month of last year and I’m curious to see where my year ends up.

December Dividend Income

For the month of December I received dividends from 20 different companies (and 1 company twice):

| Ticker | Company Name | Amount |

| TSE:AX.UN | Artis REIT | $99.00 |

| TSE:CWB | Canadian Western Bank | $82.57 |

| TSE:PLZ.UN | Plaza REIT | $69.24 |

| ORI | Old Republic | $65.63 |

| TSE:CLF | Bonds | $61.73 |

| CVE:PTG | Pivot | $50.00 |

| TSE:NVU:UN | Northview Apartment REIT | $45.90 |

| TSE:SU | Suncor | $41.47 |

| TSE:NVU.UN | Northview Apartment REIT | $40.74 |

| TSE:D.UN | Dream Office REIT | $37.50 |

| AIG | American International | $32.00 |

| TSE:BIP.UN | Brookfield Infr | $24.29 |

| TSE:TS.B | TorStar | $20.43 |

| TSE:BEI.UN | Boardwalk REIT | $19.13 |

| TSE:XBB | Bonds | $18.19 |

| TSE:PZA | Pizza Pizza | $16.04 |

| TSE:POW | Power Corp | $11.73 |

| TSE:XLB | Bonds | $9.82 |

| TSE:SJR.B | Shaw | $7.41 |

| NVDA | Nvidia | $7.00 |

| TSE:MG | Magna International | $6.56 |

| Total | $766.38 |

I received $766.38 in dividends for the month of December. That is 70 hours paid at B.C.’s minimum wage of $10.85 per hour!

Nuts and Bolts

- My year over year increase was 21.8% or $136.57 more then 2015

- My quarter over quarter increase was 6.02%

- I had a decent quarter, I’m moving in the right direction

| Month | 2015 | 2016 | 2016 $INC | 2016 %INC |

| January | $152.00 | $367.00 | $215.00 | 141.45% |

| February | $229.00 | $427.00 | $198.00 | 86.46% |

| March | $385.00 | $602.00 | $217.00 | 56.36% |

| April | $201.00 | $313.00 | $112.00 | 55.72% |

| May | $375.00 | $456.00 | $81.00 | 21.60% |

| June | $475.00 | $676.00 | $201.00 | 42.32% |

| July | $200.00 | $380.00 | $180.00 | 90.00% |

| August | $375.00 | $501.00 | $126.00 | 33.60% |

| September | $499.00 | $716.88 | $217.88 | 43.66% |

| October | $236.00 | $479.38 | $243.38 | 103.13% |

| November | $418.00 | $514.57 | $96.57 | 23.10% |

| December | $624.00 | $760.03 | $136.03 | 21.80% |

| YTD Total | $4,169.00 | $6,192.86 | $2,023.86 | 48.55% |

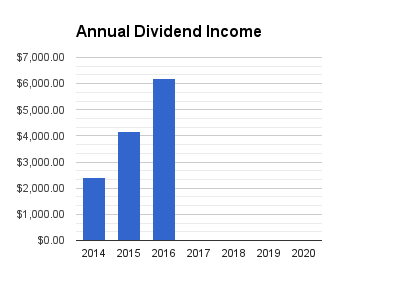

My total dividend haul this year is now $6,192.86, $2,023.86 more than my last years total.

Every quarter there are 3 months or dividend payouts, this is the big one.

I passed my last years total in October. This year, I had a goal of $6,000 and just squeaked past.

How Much Free Money?

| Year | Total Dividends Received |

| 2014 | $2,421.00 |

| 2015 | $4,169.00 |

| 2016 | $6,193.00 |

| 2017 | $0.00 |

| 2018 | $0.00 |

| 2019 | $0.00 |

| 2020 | $0.00 |

| Total | $12,783 |

Since 2014 I have received $12,783 of free money just to own some companies.

I hope everyone else had a great year.

Dividend Income – December 2016 Read More »