Dividend Income – January 2017

Last month was my best payday ever with a dividend income of $766.38 for December. That put my year total to over the 6G mark that I was pushing hard to hit. Let’s take a look at January.

This year, my goal is to smash $8,000! It’s a pretty lofty goal and I figure I need to save around 50 grand of new capital to hit this mark, based on a 4% dividend on new purchases.

$50,000 will be around a 70% savings rate. I’m not going to lie, this is going to be extremely difficult. A family of 5 on a single income with children in every activity known to man, we shall see…

January Dividend Income

For the month of January I received dividends from 14 different companies (and 1 company twice):

| TICKER | COMPANY NAME | AMOUNT |

| TSE:AX.UN | Artis REIT | $99.72 |

| TSE:CLF | Canada Bonds | $72.00 |

| TSE:PLZ.UN | Plaza REIT | $69.54 |

| TSE:AQN | Algonquin | $69.24 |

| WDC | Western Digital | $60.50 |

| TSE:NVU.UN | Northview Apartment REIT | $46.17 |

| TSE:NVU:UN | Northview Apartment REIT | $41.01 |

| TSE:D.UN | Dream Office REIT | $37.75 |

| TSE:TA | TransAlta | $35.60 |

| BEN | Franklin Resources | $30.00 |

| TSE:ALA | AtlaGas | $26.51 |

| TSE:BEI.UN | Boardwalk REIT | $19.13 |

| TSE:PZA | Pizza Pizza | $16.04 |

| TSE:CPG | Cresent | $9.00 |

| TSE:SJR.B | Shaw | $7.41 |

| TOTAL | $639.32 |

I received $639.32 in dividends for the month of January.

What should I do with all this free cash? I could buy a…

LG 43″ 4K UHD Smart LED with WebOS 3.0

Full HD 1080p with a whopping 8.3 million pixels!!!!

Well, instead of buying a nice TV, I decided to DRIP my money to buy more high quality stocks to compound that growth!

43″ just ain’t good enough.

Nuts and Bolts

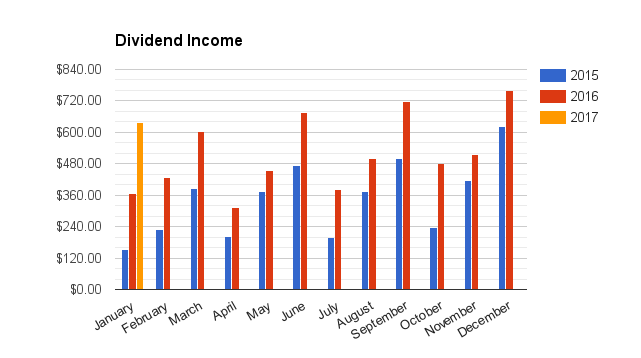

- My year over year increase was 74.15% or $272.12 more than January 2016

- My quarter over quarter increase was 33.32%

- I had a great quarter, I’m moving in the right direction

| Month | 2015 | 2016 | 2017 | 2017 $ INC | 2017 % INC |

| January | $152.00 | $367.00 | $639.12 | $272.12 | 74.15% |

| February | $229.00 | $427.00 | $0.00 | 0 | 0.00% |

| March | $385.00 | $602.00 | $0.00 | 0 | 0.00% |

| April | $201.00 | $313.00 | $0.00 | 0 | 0.00% |

| May | $375.00 | $456.00 | $0.00 | 0 | 0.00% |

| June | $475.00 | $676.00 | $0.00 | 0 | 0.00% |

| July | $200.00 | $380.00 | $0.00 | 0 | 0.00% |

| August | $375.00 | $501.00 | $0.00 | 0 | 0.00% |

| September | $499.00 | $716.88 | $0.00 | 0 | 0.00% |

| October | $236.00 | $479.38 | $0.00 | 0 | 0.00% |

| November | $418.00 | $514.57 | $0.00 | 0 | 0.00% |

| December | $624.00 | $760.03 | $0.00 | 0 | 0.00% |

| YTD Total | $4,169.00 | $6,192.86 | $639.12 | $272.12 | -89.68% |

My total dividend haul this year has started off well at $639.12. I only need $5,553.74 to hit my last years total

Last year I passed my prior year in October. I’m trying to beat 2016 total even sooner this year.

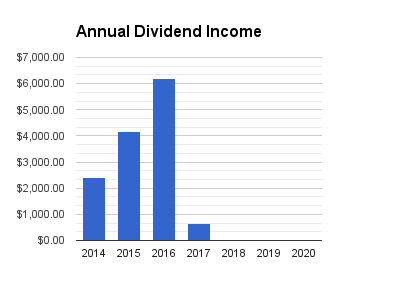

How Much Free Money?

| Year | Total Dividends Received |

| 2014 | $2,421.00 |

| 2015 | $4,169.00 |

| 2016 | $6,193.00 |

| 2017 | $639.00 |

| 2018 | $0.00 |

| 2019 | $0.00 |

| 2020 | $0.00 |

| Total | $13,422 |

Since 2014 I have received $13,422 of free money just to own some companies.

That’s enough free money to buy my a brand new…

Mitsubishi Mirage ($12,698)

I hope everyone else has a great year.

Dividend Income – January 2017 Read More »