Dividend Income – February 2017

Last month I received a dividend income of $639.32 for January. It was a great start to the year and I hope to keep the momentum going. Let’s check out February.

This year, my goal is to pass $8,000 in total dividends received. All I need now is a measly $7,360 🙂

February Dividend Income

For the month of February I received dividends from 12 different companies.

| Ticker | Company Name | Amount |

| TSE:AX.UN | Artis REIT | $100.44 |

| TSE:NVU.UN | Northview Apartment REIT | $87.72 |

| TSE:RY | Royal Bank | $87.15 |

| TSE:PLZ.UN | Plaza REIT | $72.52 |

| TSE:CLF | Bonds | $55.31 |

| TSE:D.UN | Dream Office REIT | $37.88 |

| TSE:SJR.B | Shaw | $30.62 |

| TSE:ALA | AtlaGas | $26.51 |

| TSE:BEI.UN | Boardwalk REIT | $19.13 |

| TSE:PZA | Pizza Pizza | $16.04 |

| TSE:PWF | Power Financial | $14.92 |

| TSE:CPG | Cresent | $9.00 |

| TOTAL | $557.24 |

I received $557.24 in dividends for the month of February.

What should I do with all this free cash? I could buy a new…

Playstation 4 Pro (with one extra game)

Nope!

As any reader knows, I prefer to spend my dividends on things that go up in value. I chose to DRIP my dividends.

I know many people don’t like to DRIP and prefer to take cash instead. The reason I like to invest my money through dividend reinvesting is 2 parts.

- I don’t pay a transaction fee, which doesn’t seem like much, but they do add up fast.

- I get a DRIP discount on new shares below market price, usually by around 5%

Nuts and Bolts

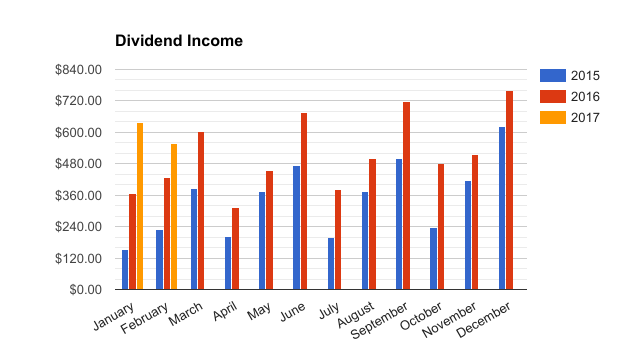

- My year over year increase was 30.50% or $130.24 more than February 2016

- My quarter over quarter increase was 33.32%

- Another solid quarter

| Month | 2015 | 2016 | 2017 | 2017 $ INC | 2017 % INC |

| January | $152.00 | $367.00 | $639.12 | $272.12 | 74.15% |

| February | $229.00 | $427.00 | $557.24 | $130.24 | 30.50% |

| March | $385.00 | $602.00 | $0.00 | 0 | 0.00% |

| April | $201.00 | $313.00 | $0.00 | 0 | 0.00% |

| May | $375.00 | $456.00 | $0.00 | 0 | 0.00% |

| June | $475.00 | $676.00 | $0.00 | 0 | 0.00% |

| July | $200.00 | $380.00 | $0.00 | 0 | 0.00% |

| August | $375.00 | $501.00 | $0.00 | 0 | 0.00% |

| September | $499.00 | $716.88 | $0.00 | 0 | 0.00% |

| October | $236.00 | $479.38 | $0.00 | 0 | 0.00% |

| November | $418.00 | $514.57 | $0.00 | 0 | 0.00% |

| December | $624.00 | $760.03 | $0.00 | 0 | 0.00% |

| YTD Total | $4,169.00 | $6,192.86 | $1,196.36 | $402.36 | 0.00% |

One of my goals for 2017 is to increase my dividend payout an average of $170 per month. I’m slightly ahead of schedule with an average increase of $201 per month. ($402/2)

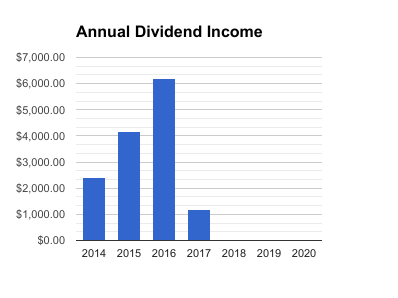

My total dividend haul this year is already over the thousand dollar mark sitting at $1,196. It’s crazy to think that I have already accumulated 50% of my 2014 total in just 2 months! How cool is that.

How Much Free Money?

| Year | Total Dividends Received |

| 2014 | $2,421.00 |

| 2015 | $4,169.00 |

| 2016 | $6,193.00 |

| 2017 | $1,196.00 |

| 2018 | $0.00 |

| 2019 | $0.00 |

| 2020 | $0.00 |

| Total | $13,979 |

Since 2014 I have received $13,979 of free money just to own some companies.

That’s enough free money to buy my a brand new…

2016 Bayliner 160 OB

Stay classy Fire bros

Dividend Income – February 2017 Read More »