DIVIDENDS!!

I received $313.14 in dividends in April.

Not the biggest haul but Jan, Apr, Jul and Oct are slower months for dividends.

The market has come roaring back with the help of oil trading around $46 and has brought out the bear in me. I’m not a big fan of timing the market though I do think that it doesn’t hurt to start holding a little bit more cash at the moment.

Moves in April

I sold 2000 shares of Kingold Jewelry for $1.34 USD netting a capital gain of 26.42%. I bought Kingold back in July 2015 for $1.06 USD as one of my “impulse” buys, one that I was really regretting as I watched this stock nose dive all the way down to around $0.49 by mid Jan 2016. Lucky for me, GOLD has become in vogue and gave me a nice opportunity to exit my position and learn from it. Although I made a little bit of money, I still consider the purchase of KGJI a mistake.

I also exited my position from Cominar. I sold 350 shares for $17.20 netting a capital gain of 8.18%. I still like Cominar but as I mentioned above, i’m moving towards safety and as of today Cominar’s AFFO is sitting around 90% which could possibly mean a cut to it’s dividend in the future.

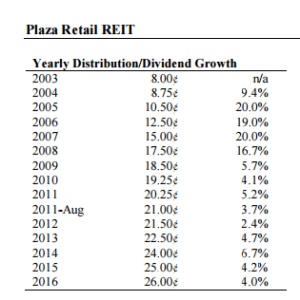

I bought 1340 shares of Plaza Retail at the not great price of $4.70. I more or less sold Cominar to buy Plaza and the reason behind it is the payout ratio.

FFO/AFFO

Payout Ratios 2015 2014

Distributions as a % of AFFO 78.6% 80.5%

The lower the payout ratio is the better and as you can see, even after increasing the payout, they still lowered their ratio.

Also, Plaza has increased its payout every year for the past 13 years.

Last but not least I added $5420 of new capital to my savings investment account. I don’t like just holding on to cash so I bought 275 shares of CLF which are Canadian ladder bonds. They generate around $0.05 per share per month. It’s not much but it’s better than getting burned on the cornballer. My new total CLF now sits at 1325 shares.