Can you believe 2024 is already over?

“The intelligent investor is a realist who sells to optimists and buys from pessimists.” – Benjamin Graham.

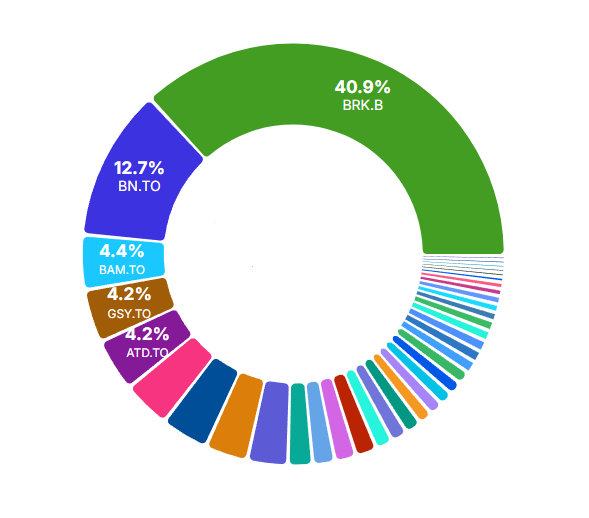

I picked up some more BRK.B. I now am very overweight in Berkshire but I don’t view that as a terrible problem to have.

I plan to keep adding more BRK.B and some low dividend ETF’s to my taxable account every month. My dividend increase will remain fairly steady until I get raises from existing companies or until the start of next year when I will have more room in my tax-free accounts.

Let’s check out Some 2024 things

My Investment strategy has developed and continues to develop as things change,

My 2 largest holdings and top 6 out of 10 pay little to no dividends,

$BRK at 0% $BN at %0.52 $GSY, $ATD, and $XSP are all fairly little.

I do this because I have my TFSA and RRSP’s maxed and do not want to pay any more taxes so I hold these in my taxable accounts.

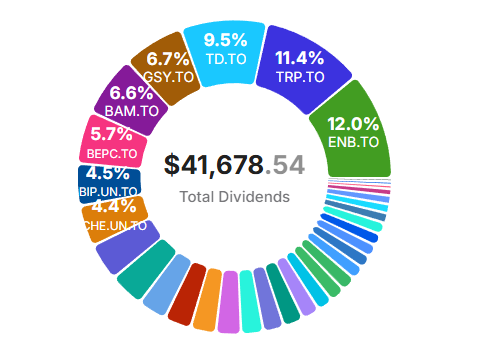

Dividend Income

For the month of January, I received dividends from 23 different companies.

| Ticker | Company Name | JAN |

|---|---|---|

| TSE:TVE | Tamarack | $77.21 |

| TSE:WCP | WCP | $46.21 |

| TSE:SGY | Surge | $51.57 |

| TSE:PEY | Peyto | $70.29 |

| TSE:CASH | CASH | $150.74 |

| TSE:CHE.UN | Chemtrade | $143.44 |

| TSE:ADEN | Adentra | $75.00 |

| TSE:BNS | Scotia Bank | $311.64 |

| TSE:ARX | ARC | $114.95 |

| TSE:TRP | TC Energy | $1,182.76 |

| TSE:GSY | GoEasy | $617.76 |

| TSE:TFII | TFI | $126.11 |

| TSE:TIH | TOROMONT | $84.48 |

| TSE:VSP | S&P | $8.66 |

| TSE:XSP | S&P | $577.75 |

| TSE:BTE | Baytex | $69.91 |

| TSE:ATD | ATD | $264.82 |

| TSE:MEG | MEG | $120.00 |

| TSE:SOBO | Sobo | $205.04 |

| DG | DG | $148.79 |

| TSE:SES | Ses | $100.23 |

| TSE:GSY | Goeasy | $79.38 |

| Total | $4526.51 |

- I received $4500

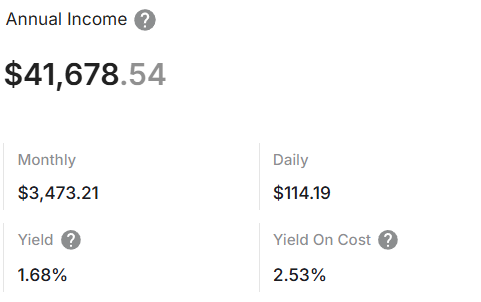

- My total forward dividends are $41k

- My Yield is %1.68 and my YOC is 2.53

- I have lots of BRK

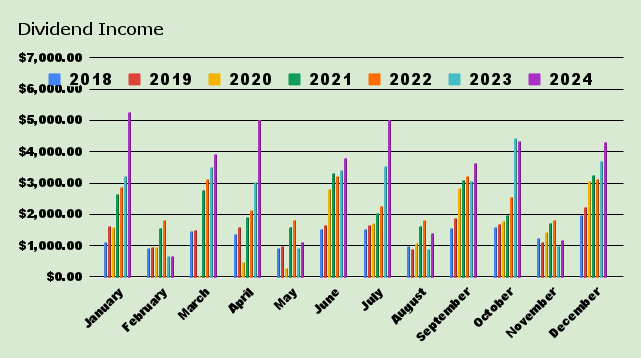

Dividend Increase and highlights

Feb 1, 2024 BIP TSE:BIP $1.53 $1.62 5.88%

Feb 2, 2024 BEPC TSE:BEPC $1.35 $1.42 5.19%

Feb 6, 2024 BAM TSE:BAM $1.28 $1.52 18.75%

Feb 8, 2024 BN TSE:BN $0.28 $0.32 14.29%

Feb 13, 2024 GSY TSE:GSY $3.84 $4.68 21.88%

Feb 22, 2024 THI TSE:TIH $1.72 $1.92 11.63%

Feb 26, 2024 TRP TSE:TRP $3.72 $3.84 3.23%

Feb 28, 2024 EQB TSE:EQB $1.60 $1.68 5.00%

May 15, 2024 cve $0.56 $0.72 28.57%

May 28, 2024 eqb $1.68 $1.80 7.14%

July 31, 2024 cpx $2.46 $2.61 6.10%

Oct 21 eqb $1.80 $1.88 4.44%

Oct 23, 2024 tfii $1.60 $1.80 12.50%

Nov 10 adentra $0.56 $0.60 7.14%

Nov 12 congeco $3.42 $3.68 7.60%

Nov 13 bip $1.62 $1.72 6.17%

Nov 24 atd $0.70 $0.78 11.43%

Dec 3 enb $3.66 $3.77 3.01%

Jan 31 2025 bepc $1.42 $1.49 4.93%

Nuts and Bolts

How Much Free Money?

I’ve earned $12,000 in dividends so far this year. Not bad taking 3 months off. I guess im averaging about 2 grand a month right now, give or take.

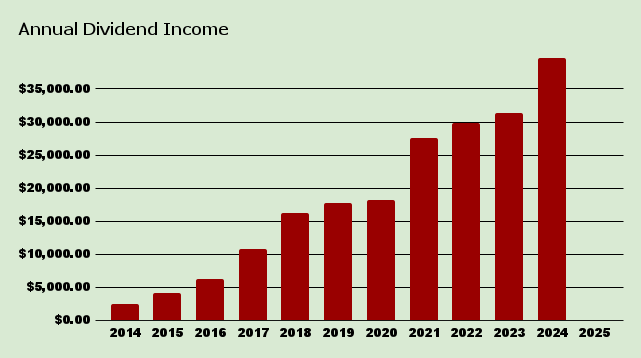

| Annual Dividends | ||

| Year | Total Dividends Received | Total Yearly Div Increase |

| 2014 | $2,421.00 | $2,421.00 |

| 2015 | $4,169.00 | $1,748.00 |

| 2016 | $6,192.86 | $2,023.86 |

| 2017 | $10,760.51 | $4,567.65 |

| 2018 | $16,223.07 | $5,462.56 |

| 2019 | $17,804.61 | $1,581.54 |

| 2020 | $18,115.00 | $310.39 |

| 2021 | $27,585.08 | $9,470.08 |

| 2022 | $29,835.00 | $2,249.92 |

| 2023 | $31,383.00 | $1,548.00 |

| 2024 | $39,717.81 | $8,334.81 |

2025 $4,526.51

Since 2014 I have received $208,733.45 worth of dividends. This does not include any capital appreciation or USD

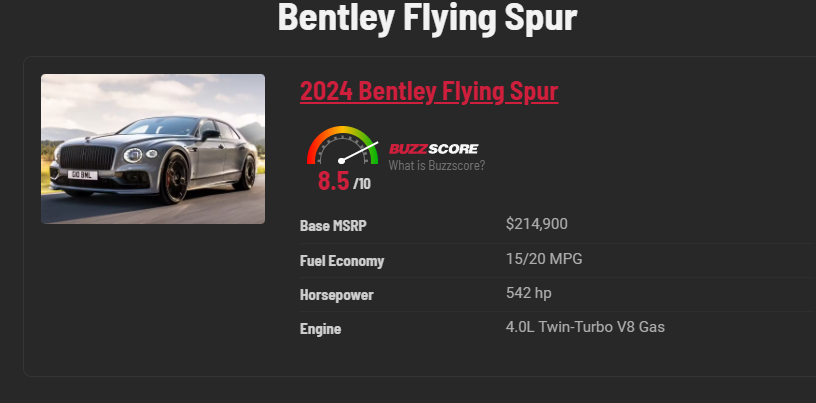

What can I buy with all my free money?

Now, saying that, I’m going to buy a brand new…

Not bad for doing nothing

Until next time.

Stay classy Fire bros