Last month I received a dividend income of $5,797.91 (Jan 2024)

Life Update!

It’s been a minute.

Life gets busy with 3 kids in sports (and expensive). I’ve been meaning to update this site for the longest time but life. It’s been so long, I don’t even remember where I left off.

My Oldest kid is going into grade 12 and we are on the hunt for Universities. All 3 of my kids play rep sports and the time and money these take is unbelievable, I’m not sure I would wish the stress and busyness on my worst enemy. There is a light at the end of the tunnel as my daughter will be driving soon and will take herself to practices, we play for a city that is an hour away 5 days a week 🙁 so that will free up a large amount of time.

January Dividend Income

For January I received dividends from 26 companies. Some are duplicates because I have the same company in different accounts.

I received $5,797.91 in dividends.

| Ticker | Company Name | DIV SCHD | Jan |

| TSE:TRP | TC Energy | A | $1,243.40 |

| TSE:BNS | Scotia Bank | A | $1,018.66 |

| TSE:XSP | S&P | A | $510.47 |

| TSE:GSY | GoEasy | A | $445.44 |

| TSE:ARX | ARC | A | $345.61 |

| TSE:HWX | Headwater | A | $345.60 |

| TSE:CPX | Capital Power | A | $310.00 |

| TSE:CMR | MM Fund | A | $297.00 |

| TSE:ATD | ATD | A | $237.00 |

| BABA | Ali BABA | A | $196.00 |

| TSE:TFII | TFI | A | $104.64 |

| TSE:WCP | White Cap | A | $87.55 |

| TSE:TVE | Tamarack | A | $76.73 |

| TSE:TIH | Toromont | A | $75.68 |

| TSE:UFC.v | Urban Fund | A | $75.00 |

| NTR | Nutrien | A | $73.47 |

| TSE:ADEN | Adentra | A | $70.00 |

| TSE:BTE | Baytex | A | $68.56 |

| TSE:TVE | Tamarack | A | $67.29 |

| TSE:GSY | Goeasy | A | $62.25 |

| TSE:SGY | Surge | A | $41.80 |

| TSE:ARX | Arc | A | $30.26 |

| TSE:VSP | S&P | A | $8.44 |

| TSE:EFN | Element Fleet | A | $5.83 |

| TSE:ATD | ATD | A | $1.23 |

| TOTAL | $5,797.91 |

The year started out well with most of the companies raising their dividends.

The largest raises came from,

ATD 25%, GSY 22%, EQB 22%, BAM 19%, BN 14%, TFII 14. These companies are also some of my favorites and top holdings.

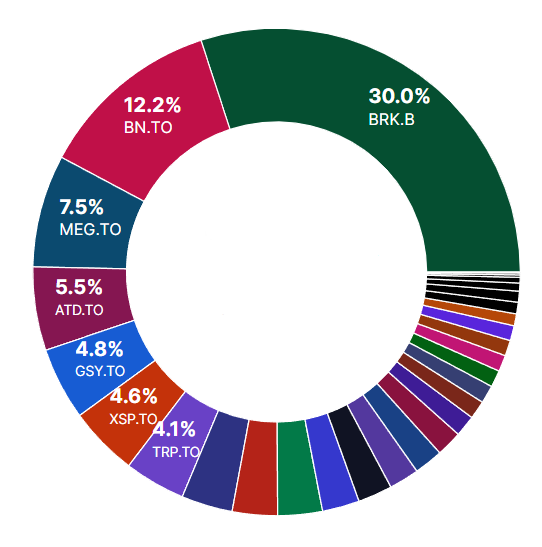

Portfolio update

Over the last several years I have moved away from focusing on dividends to focusing on compounding growth with sustainable dividend growth at the center. Sometimes it even makes sense to buy a company that is not paying a dividend if they are responsible with the FCF and can return it to the shareholder in a different way, maybe in the way of share buybacks or growing the business through acquisitions.

The largest position in my book doesn’t pay a dividend and I don’t expect it ever will. Berkshire, BRK

My second largest holding is Brookfield, BN and they pay a small yield of 0.78% I currently have nearly 5000 shares of Brookfield but want to bring that up to 10k shares in the next few years.

My top 4 holdings make up over 50% of my portfolio and have a very low total dividend payout. My current yield is sitting at just over 1.5% and you will notice in February, I collect very little in dividends for that month, around $1000 to $1500. I won’t buy a company just to pad my dividend total.

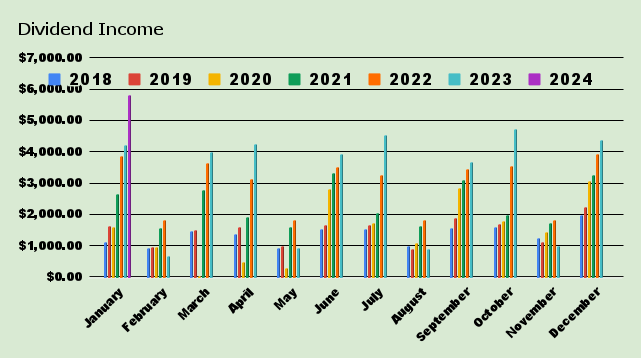

Dividend Income

| Annual Dividends | ||

| Year | Total Dividends Received | Total Yearly Div Increase |

| 2014 | $2,421.00 | $2,421.00 |

| 2015 | $4,169.00 | $1,748.00 |

| 2016 | $6,192.86 | $2,023.86 |

| 2017 | $10,760.51 | $4,567.65 |

| 2018 | $16,223.07 | $5,462.56 |

| 2019 | $17,804.61 | $1,581.54 |

| 2020 | $18,115.00 | $310.39 |

| 2021 | $27,585.08 | $9,470.08 |

| 2022 | $35,635.36 | $8,050.28 |

| 2023 | $37,165.14 | $1,529.78 |

| 2024 | $5,797.91 | |

| Total Dividends | $181,869.54 | |

It’s pretty wild to see the dividend growth from when I began tracking it in 2014. Since then I have received almost 200k in free money.

RE update

I’m currently working on closing my 5th property, It’s my first apartment so let’s see how it goes. It’s located in Tampa Bay where I’d like to eventually snowbird to when the Kido’s grow up. Also, my daughter might go play ball down there so it doesn’t hurt to have a home base close. I also have 2 other properties in Orlando. I was planning to be way more active buying RE but after COVID-19 the prices went bananas and over extended IMO. Finally, we are seeing a price correction and Tampa is coming down hard (I want the prices to go lower)

Anyhow, Saturday morning is almost done and I have to run to the softball field for a game at 11:00

Ill try and update more often when time permits.

As always, Stay Classy Fire Friends.

Steve