Can you believe September 2020 is already over?

Seriously 2020, you need to slow down…

Well, as many of you may know, the market was not very good for last month so I did what any smart investor would do.

I sold everything, again…

I kid.

“The intelligent investor is a realist who sells to optimists and buys from pessimists.” – Benjamin Graham.

I picked up some more BRK.B. I now am very overweight in Berkshire but I don’t view that as a terrible problem to have.

I plan to keep adding more BRK.B and some low dividend ETF’s to my taxable account every month. My dividend increase will remain fairly steady until I get raises from existing companies or until the start of next year when I will have more room in my tax-free accounts.

Let’s check out September 2020

Dividend Income

For the month of September, I received dividends from 26 different companies.

| Ticker | Company Name | Sep |

| TSE:PLZ.UN | Plaza REIT | $24.45 |

| TSE:SOT.UN | Slate office | $104.43 |

| TSE:IPL | Inter Pipeline | $40.40 |

| LL | Lending Loop | $40.00 |

| UTG | Reaves Utility | $29.70 |

| TSE:ALA | Alta Gas | $51.20 |

| TSE:PLC | Park Lawn | $11.40 |

| TSE:REI.UN | Riocan | $86.04 |

| TSE:EIF | Exchange Inc | $39.90 |

| TSE:PPL | Pembina | $35.70 |

| TSE:SU | Suncor | $74.13 |

| TSE:CWB | Canadian Western Bank | $102.66 |

| TSE:BIP.UN | Brookfield Infr | $63.89 |

| TSE:ENB | Enbridge | $413.10 |

| TSE:CU | Canadian Utility | $131.49 |

| BPY.UN | Brookfield Prop | $725.92 |

| TSE:ACO.X | Atco | $120.99 |

| TSE:XTC | Exco Tech | $95.00 |

| TSE:BIPC | Brookfield Corp | $6.96 |

| TSE:BAM.A | Brookfield | $94.81 |

| TSE:EQB | EQ Bank | $47.73 |

| TSE:MFC | Manulife | $225.96 |

| TSE:CCL.B | CCL Industries | $18.00 |

| TSE:MX | Methanex | $20.00 |

| WBA | Wall Greens | $58.91 |

| TSE:XSP | S&P | 0 |

| PRU | Prudential | $146.30 |

| TSE:ABX | Barrick Gold | $29.91 |

| BRK.B | Berkshire | 0 |

| TOTAL | $2,838.98 |

- I received $2838 in dividends for September

Should be well above 3g next quarter when some ETF’s I own pay up

Dividend Increase and highlights

- I havent been following this too closley as my stocks are fairly passive atm with most of my capital tied up in ETF’s for the moment while I focus on my new ventures.

- Ill update this part later in the year when I get a chance

I own 47 companies and 4 ETF’s at the moment. I will slim down some companies but I got a little carried away when I went on my Covid shopping spree in March.

I’m not sure how many companies I own have increased their dividend payout this year.

I had 0 Dividend cuts in 2020.

Some companies I own have but I wasn’t holding any of them when they did the old choppity chop. Off the top of my head, I think cuts were to IPL, SU, MX. I think that’s it.

I bought all those copanies after the cut, for instance, my SU average is $16 so I’m still picking up a 5% yeild. My IPL was purchased at $7 so I’m still getting a 7% yeild after the cut.

If anyone is wondering how I decided to rejoin the market, It was when the fed of the US said they have a money bazooka and was not scared to fire it. And yes I think there is the possibility of massive inflation but I also thought that in 08.

Nuts and Bolts

How Much Free Money?

I’ve earned $12,000 in dividends so far this year. Not bad taking 3 months off. I guess im averaging about 2 grand a month right now, give or take.

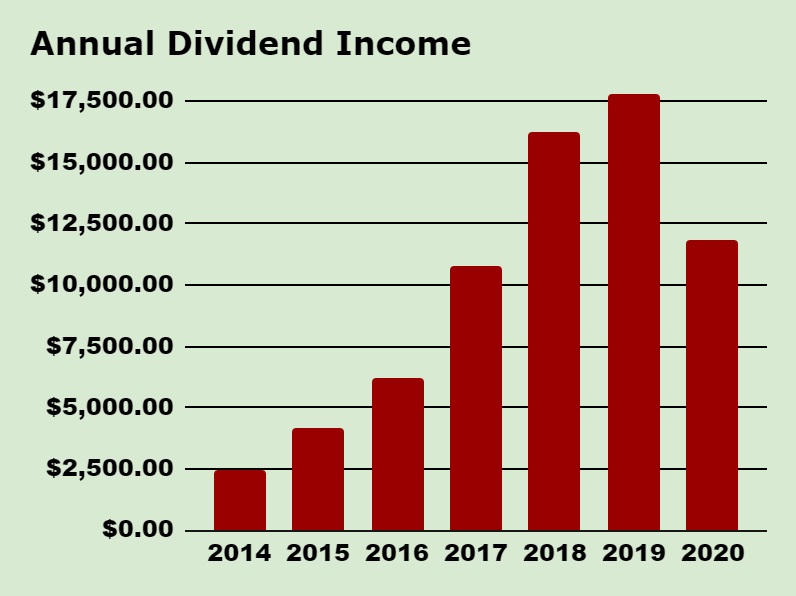

| Year | Total Dividends Received |

| 2014 | $2,421 |

| 2015 | $4,169 |

| 2016 | $6,193 |

| 2017 | $10,760 |

| 2018 | $16,233 |

| 2019 | $17,804 |

| 2020 | $11,798 |

| Total | $69,369 |

My total dividend goal this year is $?. I was aiming for a $2,000 increase every year but I think that’s not to relavant as I’m trying to keep my dividends down by loading up on Berkshire and my 1% yeilding ETF’s. I’m activly trying to keep my tax burden down during my growth stage.

If I converted all my shares to dividend players I could see my monthly haul doubling.

Since 2014 I have received $69,369 worth of dividends. This does not include any capital appreciation.

What can I buy with all my free money?

Now, saying that, I’m going to buy a brand new…

Not sure

I’m going to do this at year end. My goal was to have enough dividend money banked up to buy a house. Maybe in Deember…

Until next time.

Stay classy Fire bros

Really nice to have that much in dividends. Congrats! I have about half of that in September.

Bindu recently posted…Dividend Reinvestments of September

Awesome DC and I think it’s something great that you’ve experienced 0 cuts during these times. A testament to the quality of the portfolio I guess?

Keep it up!

Thanksm Mr Robot!