Last month I received a dividend income of $931.34 for April and May looks pretty decent as well. I’m definitely having a banner year so far but summer is a coming. Saying that, I plan to scale everything back a little so I can enjoy more time with the wife and kids for July and August.

This year, my goal is to pass $8,000 in total dividends received. Let’s check out what happened in May.

May Dividend Income

For the month of May I received dividends from 15 different companies.

| Ticker | Company Name | Dividend |

| TSE:AX.UN | Artis REIT | $102.33 |

| TSE:RY | Royal Bank | $91.35 |

| TSE:NVU.UN | Northview Apartment REIT | $84.60 |

| OHI | Omega | $75.60 |

| TSE:PLZ.UN | Plaza REIT | $73.51 |

| TSE:ALA | AtlaGas | $70.53 |

| TSE:D.UN | Dream Office REIT | $38.25 |

| TSE:ENF | Enbridge | $37.64 |

| GIS | General Mills | $31.68 |

| TSE:SJR.B | Shaw | $30.81 |

| TSE:AD | Alaris | $27.14 |

| O | Reality Income | $21.10 |

| TSE:PZA | Pizza Pizza | $17.90 |

| TSE:PWF | Power Financial | $15.68 |

| TSE:CPG | Cresent | $15.06 |

| Total | $733.18 |

I received $733.18 in dividends for the month of May.

This blows past my previous quarter by a staggering $176 dollars. Not a bad jump in 3 months 🙂

What can I buy??

Every month, after I have tallied my dividend totals, I like to see what I could do with all the free money. I do this for two reasons.

The first being that I like to feel rewarded for my hard work and when I can imagine what the money could buy me, it becomes more real than say, 4 shares of 8 different companies.

The second reason is that I fully expect to look back here in say a decade and ponder what could have been had I been a consumer rather than a saver. I imagine I will look back at that BBQ or TV in 10 years from now and I’d be just about throwing the thing out.

Now, saying that, I’m going to buy a brand new…

Outbound Steel Frame Pool, 16-ft x 48-in

Regular Price: $749.99

Nope, my yard is too small. Plus I have a outdoor public pool that costs $2 for the day!

Nope, my yard is too small. Plus I have a outdoor public pool that costs $2 for the day!

Like every month, I DRIP my dividends and buy back more shares, usually at a market discount. This is the secret to investing.

The money that I make (dividends) will now continue to make their own money! And on and on it goes.

The reason I like to invest my money through dividend reinvesting is 2 parts.

- I don’t pay a transaction fee, which doesn’t seem like much, but they do add up fast.

- I get a DRIP discount on new shares below market price, usually by around 3-5%

Nuts and Bolts

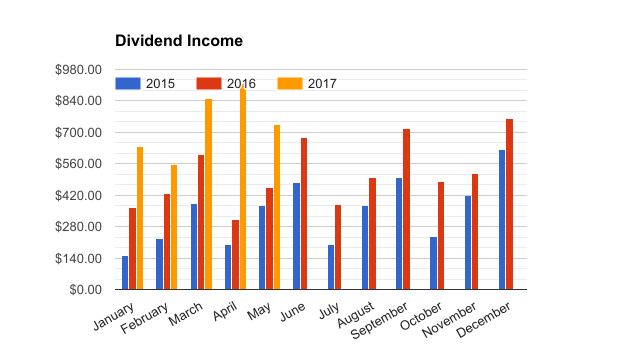

- My year over year increase was 60.79% or $277.18 more than May 2016

- My quarter over quarter increase was 31.57%

| Month | 2015 | 2016 | 2017 | 2017 $ INC | 2017 % INC |

| January | $152.00 | $367.00 | $639.12 | $272.12 | 74.15% |

| February | $229.00 | $427.00 | $557.24 | $130.24 | 30.50% |

| March | $385.00 | $602.00 | $850.50 | $248.50 | 41.28% |

| April | $201.00 | $313.00 | $931.94 | $618.94 | 197.74% |

| May | $375.00 | $456.00 | $733.18 | $277.18 | 60.79% |

| June | $475.00 | $676.00 | $0.00 | 0 | 0.00% |

| July | $200.00 | $380.00 | $0.00 | 0 | 0.00% |

| August | $375.00 | $501.00 | $0.00 | 0 | 0.00% |

| September | $499.00 | $716.88 | $0.00 | 0 | 0.00% |

| October | $236.00 | $479.38 | $0.00 | 0 | 0.00% |

| November | $418.00 | $514.57 | $0.00 | 0 | 0.00% |

| December | $624.00 | $760.03 | $0.00 | 0 | 0.00% |

| YTD Total | $4,169.00 | $6,192.86 | $3,711.98 | $1,546.98 | 0.00% |

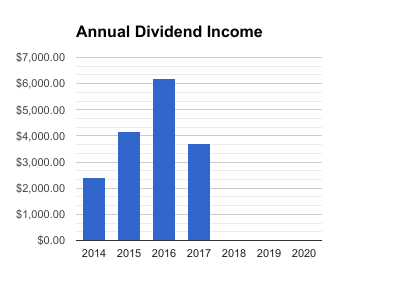

One of my goals for 2017 is to increase my dividend payout an average of $170 per month over the previous year. I’m moving quite ahead of schedule with an average increase of $309.40 per month. ($1,546.98/5). Saying that, I don’t expect to keep up at this breakneck pace through summer. My total dividend haul this year has already passed my 2014 total year and I should pass my 2015 mark by the end of June 🙂 I’m currently sitting at $3,711.98 and it’s only June 1st.

My total dividend haul this year has already passed my 2014 total year and I should pass my 2015 mark by the end of June 🙂 I’m currently sitting at $3,711.98 and it’s only June 1st.

How Much Free Money?

| Year | Total Dividends Received |

| 2014 | $2,421.00 |

| 2015 | $4,169.00 |

| 2016 | $6,193.00 |

| 2017 | $3,711.98 |

| 2018 | $0.00 |

| 2019 | $0.00 |

| 2020 | $0.00 |

| Total | $16,494.84 |

Since 2014 I have received $16,494.84 worth of dividends. This does not include any capital appreciation.

Every month I like to see what my total dividend income could purchase if I chose to spend it on frivolous stuff. Seeing as my monthly dividend bought me a fancy new above ground swimming pool, I thought what else could I buy to master my back stroke.

Turns out I could buy a …

SWIMMING POOLS – EX DISPLAY

This does look cool but I fully expect my dividends to continue to work for me and in time buy me not only the pool but the house as well.

Until next time.

Stay classy Fire bros